Broad Coverage

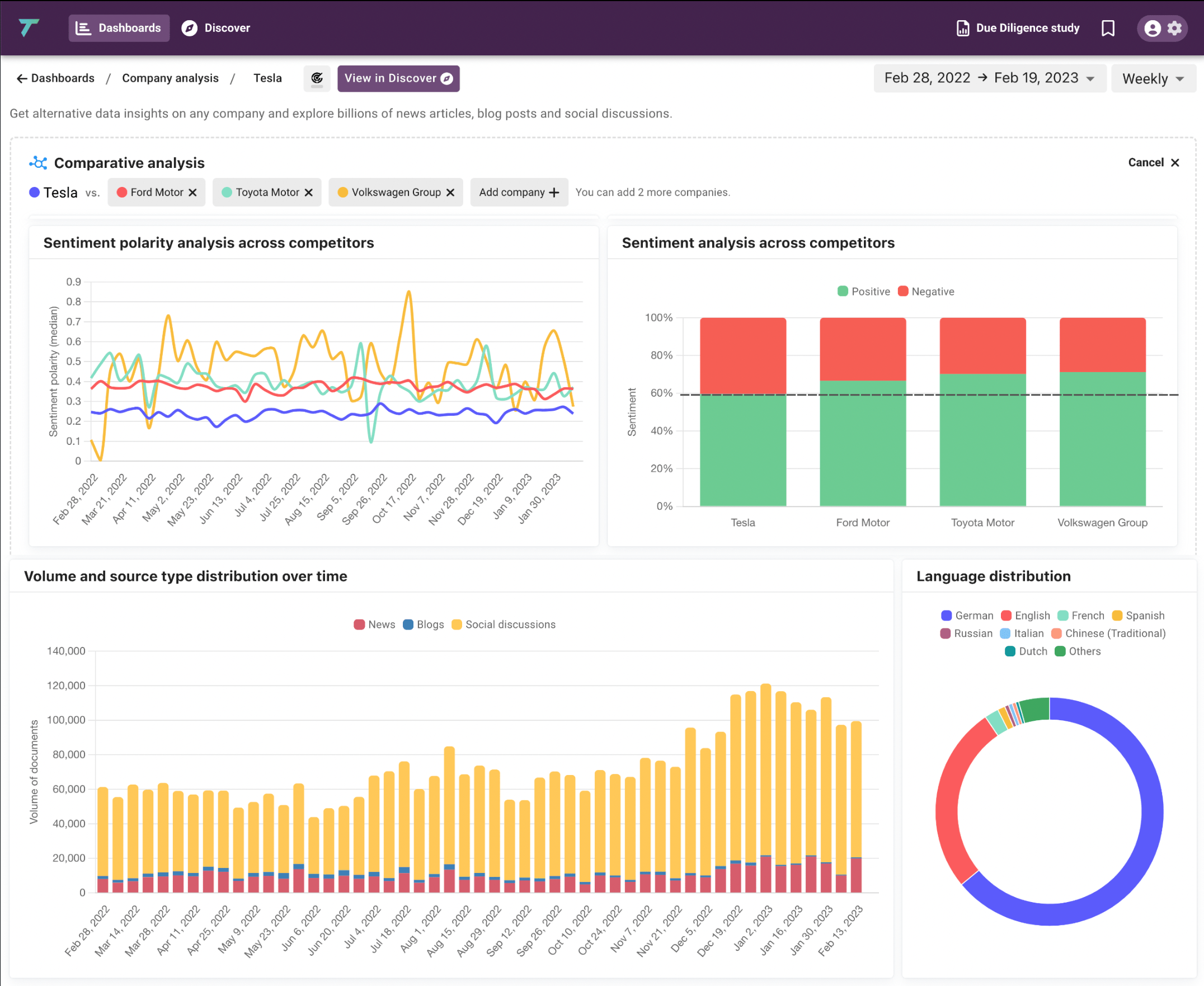

Analyze 20 billion articles on five million public and private companies in more than 100 languages daily.

Timeliness

Access near-live web data for forward-looking scores and insights.

Transparency

Learn what’s behind each alert. TextReveal allows you to dig deeper and see the specific article driving the alerts.

Expertise

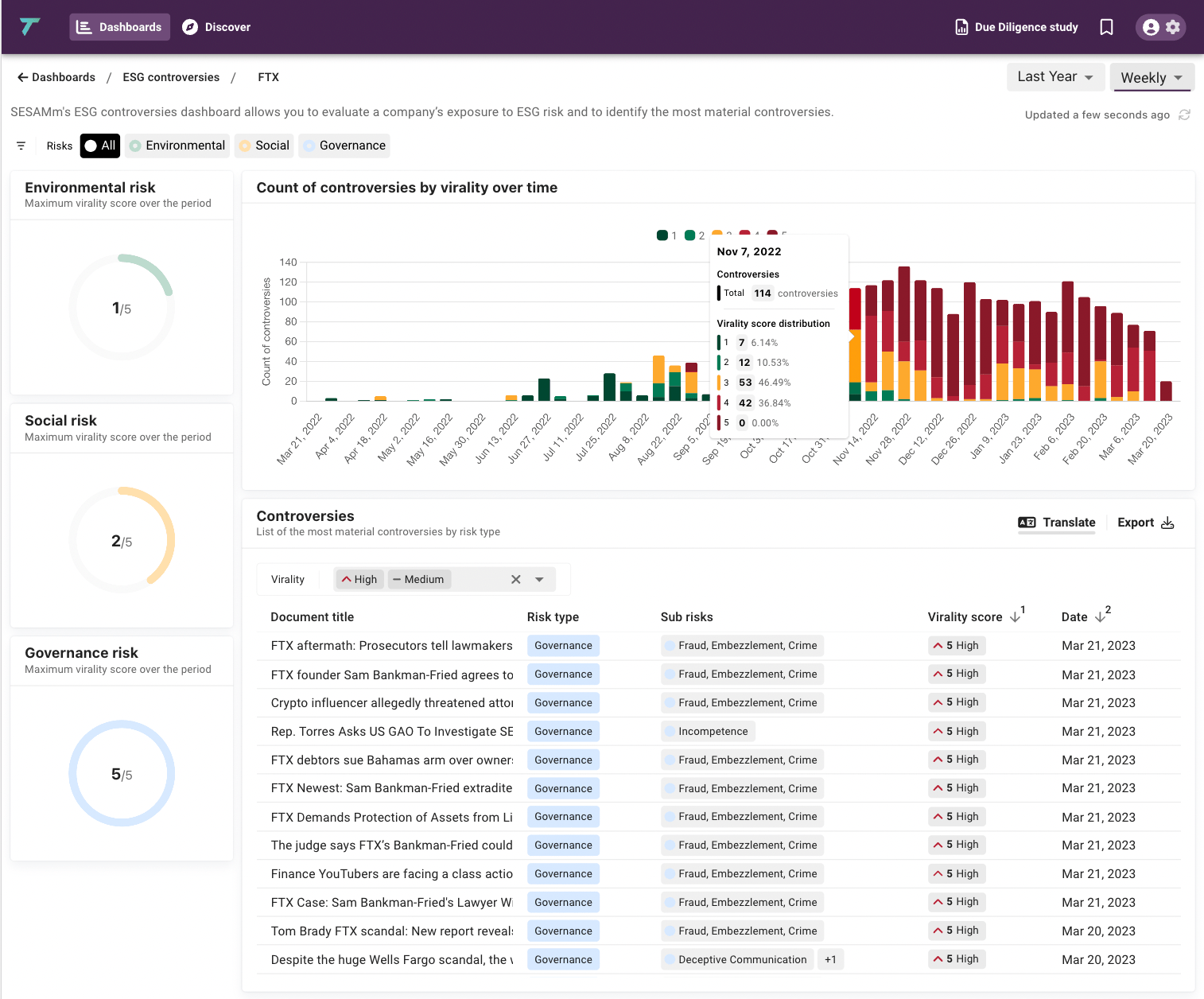

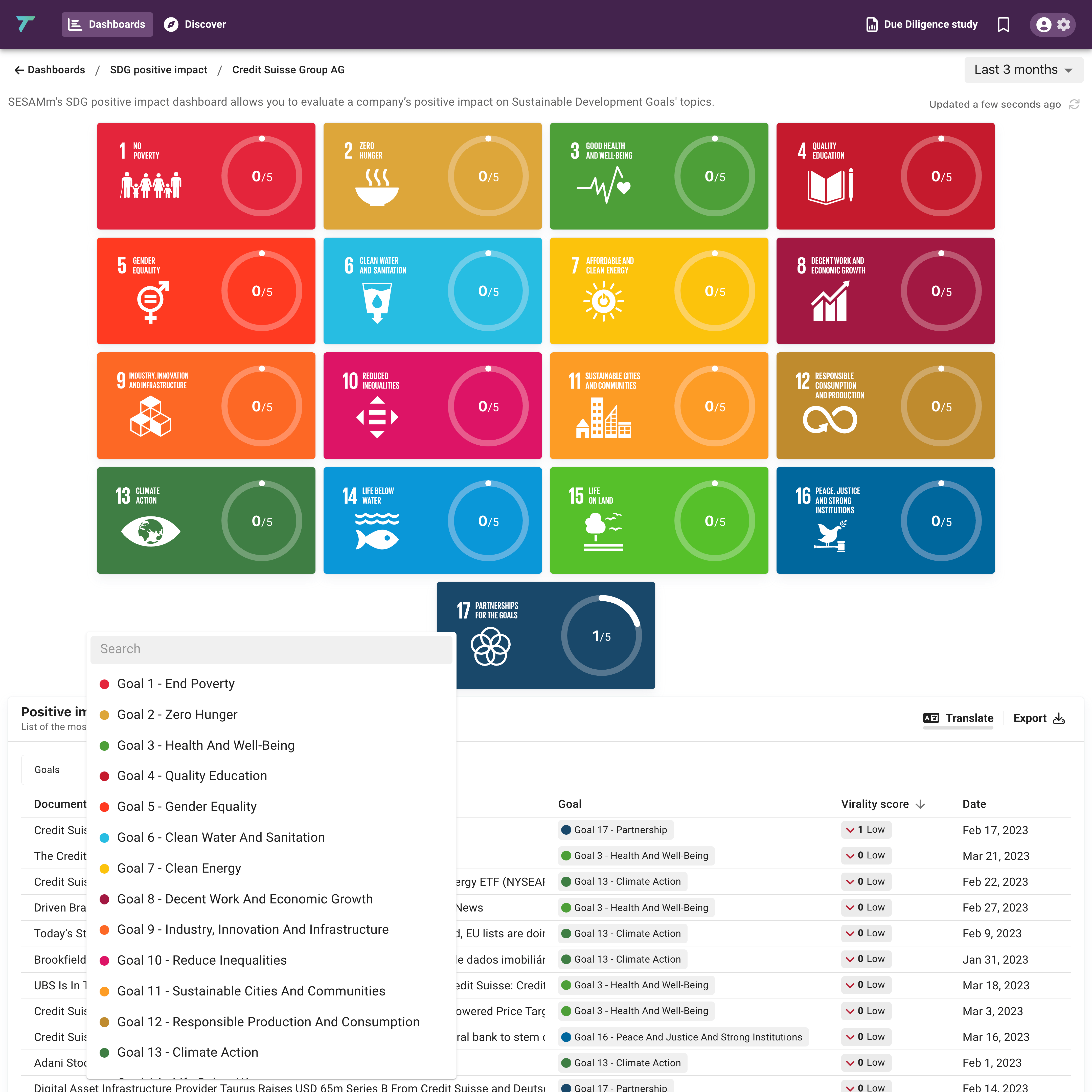

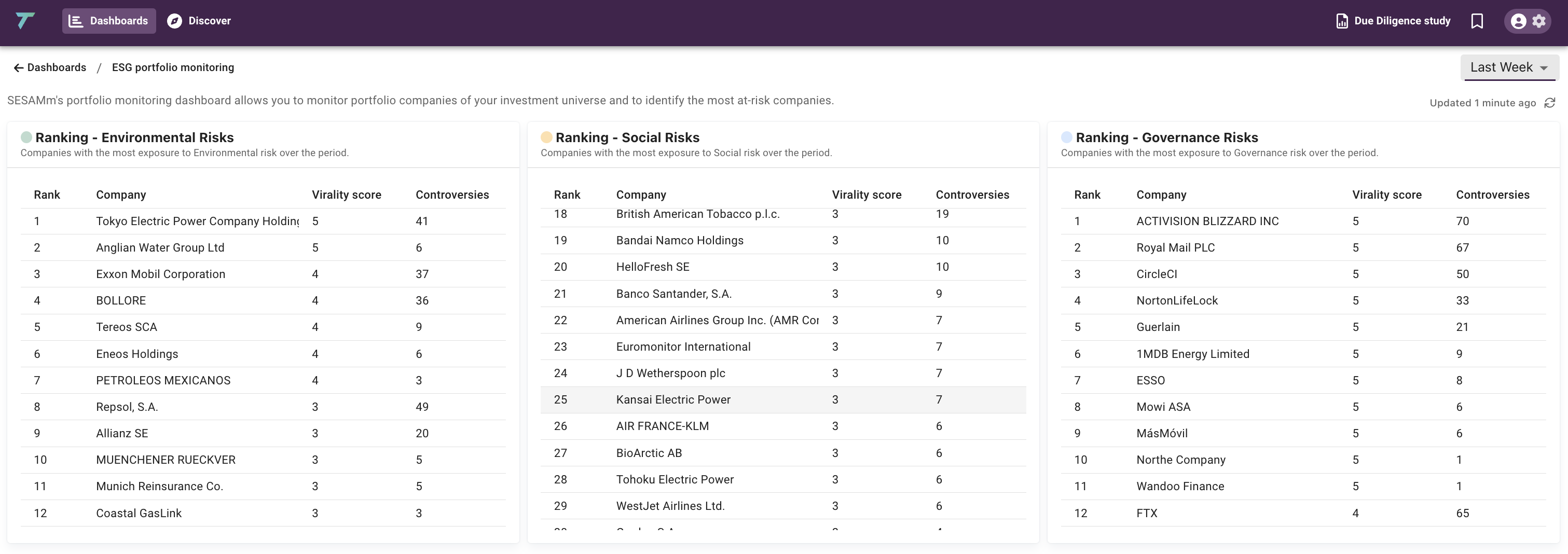

Coverage of ninety pre-built ESG risk categories (adaptable to the client’s custom taxonomy), UN Global Compact, and UN SDG-based positive impact statistics to quickly help rate and monitor companies in your portfolio.

Use Cases by Industry

Event monitoring: From email alerts on ESG controversies to comprehensive insights delivered via DealCloud, TextReveal makes it possible to monitor your portfolio companies and stay on top of risks and opportunities related to ESG and SDG events.

With SESAMm, private equity firms can make timely decisions by monitoring their portfolio companies daily and identifying potential risks and opportunities. Access ready-to-use dashboards, data directly through our API, or simply receive email alerts on companies of interest.

Develop investment strategies with SESAMm’s ESG and SDG data scores and sentiment based on web data. Our comprehensive coverage includes US 3000, Europe 600, Japan 225, emerging markets, and other world indices.

Monitor your holdings and stay on top of controversies and general risks in your invested companies with SESAMm’s email alerts. They’ll keep you informed of critical information and help you to make decisions before adverse events happen.

ESG, UN SDG, and sentiment event monitoring: Data-based insights on private companies are hard to attain through traditional methods. Nevertheless, online data exists, and SESAMm's TextReveal makes extraction and analysis possible through artificial intelligence. Dramatically enhance visibility into your company and the companies you work with. TextReveal lets you to monitor ESG controversies, UN SDG positive impact events, and general sentiment on:

- Clients

- Suppliers

- Investments

- And more

Delivery Methods

A comprehensive range of solutions to meet the needs of technical and business users

Alerts

Daily ESG and sentiment email alerts to monitor controversies of all the companies that matter to you

Live Dashboards

Ready-to-use SaaS dashboards with fully transparent and auditable results

API Access

API or flat files to extract data in a systematic way.

.png?width=1600&height=1524&name=Data%20lake%20SESAMm%202024%20(1).png)