By Magnus Billing, SESAMm advisor, with insights from Sylvain Forté, CEO of SESAMm

Investors have faced so-called “black swan” events throughout history: unexpected crises with severe consequences, often rationalized only in hindsight. Yet in an era defined by generative AI and vast, real-time data lakes, the question arises: could such events be understood and acted upon before they unfold?

The 2023 U.S. regional banking crisis offers a striking case study. The rapid collapses of Silicon Valley Bank and Signature Bank revealed how quickly stress can spread and how difficult it remains to connect early warning signs across sources.

While traditional financial analysis focuses on fundamentals such as capital ratios, liquidity positions, governance, and earnings, a new class of tools is expanding the lens. AI-driven controversy data aggregates and analyzes millions of public sources, from regulatory statements to media and industry discussions, to detect emerging issues as they surface. It does not replace quantitative and fundamental analysis; it complements it by tracking the visibility of risk as it enters public conversation.

This combination of approaches may offer investors a fuller picture: the structural risks visible in balance sheets, and the narrative risks revealed through public dialogue. To test this idea, we revisited the 2023 crisis through both perspectives, starting with what traditional analysis could have shown and what it missed.

Traditional Analysis and Its Blind Spots

In hindsight, the vulnerabilities of regional banks such as Silicon Valley Bank and Signature Bank were visible before the start of 2023. Unrealized losses on long-term securities, heavy reliance on uninsured deposits, and exposure to interest-rate risk pointed to potential liquidity stress. Yet these indicators were neither fully recognized nor connected in the market.

Traditional analysis has a tendency to evaluate banks based on their specific niches: Silicon Valley Bank focused on technology and venture financing, while Signature Bank served commercial real estate and digital asset clients. However, this approach risks overlooking the common and shared structural factors: concentrated depositor bases, high sensitivity to interest rate changes, rapid growth, and weaknesses in governance. Few, if any, observers recognized how rapidly these vulnerabilities could interact and escalate in a modern, digitalized banking environment.

While financial reports contained the data, there was little discussion connecting these risks in the public domain. But what about controversy data? Would it have caught the impending crisis? To find out, I asked Sylvain Forté, CEO of SESAMm, to provide an AI perspective.

What the Data Showed: Signature Bank

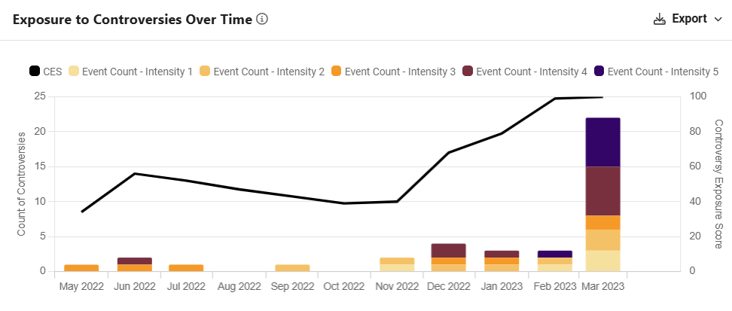

Signature Bank displayed a gradual pattern of emerging risk visible through public discussion. From mid-2022 onward, controversy data showed a rise in coverage related to governance practices, management oversight, and deposit concentration risks, often in the context of its ties to the digital-asset industry.

Importantly, it was not the crypto exposure itself that led to the bank’s collapse. The bank even announced in December 2022 that it would reduce its crypto-related business. Instead, the FDIC’s Supervision of Signature Bank report concluded that, “the root cause of SBNY’s failure was poor management. SBNY’s board of directors and management pursued rapid, unrestrained growth without developing and maintaining adequate risk management practices and controls.”

From a controversy perspective, those signals were publicly visible but fragmented. As shown in the chart above, AI-powered monitoring could have aggregated them into a clear view of a sustained drift in governance-related discussions, offering an early indication that oversight and internal controls were under pressure and risk was increasing.

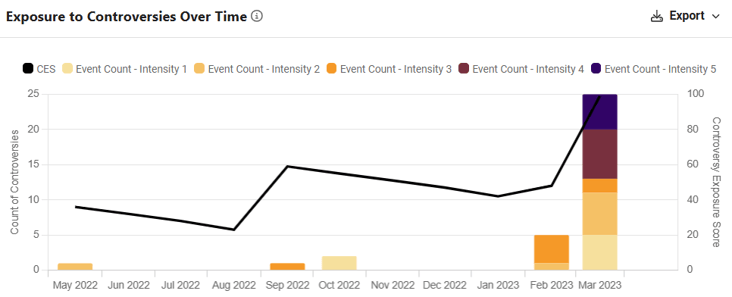

What the Data Missed: Silicon Valley Bank

In contrast, Silicon Valley Bank presented a markedly different pattern. While controversy data registered some activity in late 2022, including investor reactions to financial forecasts and coverage of routine business operations, these signals were fundamentally different in character from Signature Bank's governance-related warnings.

The September 2022 increase reflected market disappointment with financial guidance rather than operational or governance concerns. The subsequent activity captured normal business news, such as arranging syndicated loans. Critically, there was minimal public discussion of the bank's balance-sheet structure, unrealized losses, or depositor concentration risk until the crisis was already unfolding in March 2023.

This example underscores a key distinction: AI controversy monitoring excels at capturing reputational, governance, and operational risks as they enter public dialogue, but may not surface structural financial risks that remain confined to regulatory filings and analyst reports.

Lessons from Both Cases

The contrast between these two banks illustrates the complementary roles of quantitative and fundamental financial analysis vs AI-driven controversy monitoring.

In Signature Bank’s case, controversy data captured a steady accumulation of governance-related warnings, a slow build-up of risk visible through public discussion.

In Silicon Valley Bank’s case, the risks were structural but not yet discussed, leaving little for AI-powered controversy data to detect.

As Sylvain explains, “AI controversy monitoring helps investors understand how and when risks start to emerge in public dialogue. It does not replace fundamental analysis. It complements it by showing when the conversation begins to shift.”

Conclusion

Black swan events are often rationalized only in hindsight, but the 2023 regional banking crisis suggests a more nuanced reality. Some signals existed. What remained difficult was connecting them across sources before stress became contagion.

AI-driven controversy monitoring proved effective at surfacing governance and operational risks as they entered public dialogue, as Signature Bank demonstrated. Yet structural financial vulnerabilities like those at Silicon Valley Bank may not generate discussion until crisis forces the conversation, underscoring that no single lens captures all risk.

The advantage lies not in prediction, but in preparation: combining the structural risks visible in balance sheets with the narrative risks revealed through public discourse. In an era of real-time data and generative AI, the question is no longer whether information exists, but whether investors can connect it before it becomes consensus.

Reach out to SESAMm

TextReveal’s web data analysis of over five million public and private companies is essential for keeping tabs on ESG investment risks. To learn more about how you can analyze web data or to request a demo, reach out to one of our representatives.