The insurance sector continues to face mounting ESG scrutiny amid rising climate losses, digital vulnerabilities, and complex regulatory environments. Over the past three years, leading firms such as UnitedHealth Group, Prudential Financial, and AIG have faced increasing challenges related to governance oversight, social accountability, and environmental exposure. Climate-related issues have driven significant financial impacts, while increased regulatory intervention, particularly in healthcare and claims management, has underscored the cost of weak internal controls. Data breaches, legal disputes, and reputational controversies have further intensified the spotlight on insurers’ operational resilience and ethical standards. Collectively, these developments illustrate how ESG risks in the insurance industry are shifting from mere concerns to central strategic priorities.

What are the most pressing ESG challenges currently facing the insurance sector? Read on to find out.

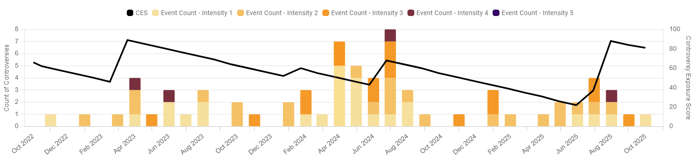

UnitedHealth Group (UNH): Governance and Regulatory Scrutiny

UnitedHealth’s ESG risks have intensified amid ongoing investigations and governance controversies. Its $3.3 billion acquisition of Amedisys has led to an antitrust lawsuit, while its Medicare Advantage business is under investigation for federal fraud. Social controversies include reports that UnitedHealth used algorithms to shorten patient rehabilitation care and paid nursing home bonuses to limit hospital transfers, prompting inquiries from U.S. senators. With its stock declining nearly 30% amid these challenges, the insurer’s case highlights the growing regulatory and ethical scrutiny of healthcare-linked financial services.

Key Controversies:

Key Controversies:

-

-

- Justice Department sues to block UnitedHealth Group's $3.3 billion purchase of Amedisys

- UnitedHealth confirms federal investigation into its Medicare practices

- UnitedHealth pushed employees to follow an algorithm to cut off Medicare patients' rehab care

- US senators Wyden and Warren launch an investigation into UnitedHealth over alleged nursing home payments

- UnitedHealth Courting White House Officials Amid Ongoing Probes

- AARP under fire after $9 billion payment from UnitedHealthcare revealed

-

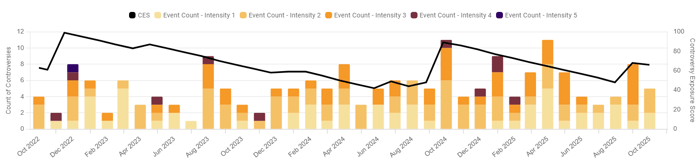

Prudential Financial Inc.: Compliance, Cybersecurity, and Consumer Protection Risks

Prudential’s ESG controversies over the past three years reflect systemic issues in data governance, workforce management, and regulatory oversight. The company announced layoffs in different regions, as well as a data breach affecting over 25 million individuals, for which a $4.75 million settlement is available to cover claims. Additionally, the U.S. Department of Labor found that Prudential had illegally denied over 200 life insurance claims, which has impacted investor confidence. These events highlight the company's vulnerabilities in compliance, cybersecurity, and consumer protection.

Key Controversies:

-

-

- Prudential and 2 North Jersey biotech firms could lay off over 200 employees

- Prudential Sued Over MOVEit Hack

- Financial giant Prudential will pay up to $5,000 per person following a massive Social Security data breach

- Prudential illegally denied life insurance claims

- Life insurer Prudential forced to pay out $7M to grieving families for unfairly denying claims

-

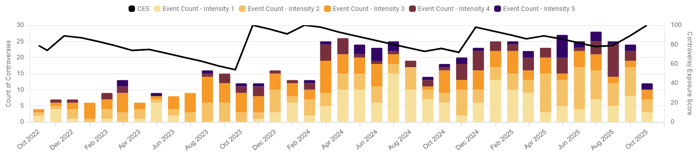

American International Group (AIG): Climate Risks and Reputational Challenges

Over the past three years, AIG has faced increased ESG scrutiny regarding climate risks and fossil fuel underwriting, reporting a 39% decline in profit and over $600 million in losses from Hurricane Ian. Activists pressure AIG to withdraw coverage for the East African Crude Oil Pipeline due to environmental concerns. On the social side, AIG has been struggling with reputational fallout from protests marking the 15th anniversary of its bailout and allegations of sexual assault involving a senior executive. On governance, AIG has been dealing with legal battles ranging from disputes over firearm-related claims and post-M&A settlements to trade secret litigation, underscoring persistent operational and compliance risks across its global portfolio.

Key Controversies:

-

-

- Insurer AIG profit slumps on hurricane costs, lower investment returns

- AIG Must Defend Aloha Petroleum in Hawaii Climate Change Cases

- Activists Call On AIG To Disavow Insurance Coverage Of East African Crude Oil Pipeline

- Former AIG Exec McElroy Faces Sexual Assault Charges in Vermont

- AIG, Firearm Retailer Set for Court Clash on 'Ghost Gun' Cases

- Delaware High Court Grills AIG, Chubb on Harman Post-M&A Accord

-

Conclusion

The recent controversies across major insurers reinforce a broader trend: the convergence of financial performance, regulatory compliance, and ESG integrity. For AIG, physical climate risk and fossil fuel exposure remain defining challenges; for Prudential, consumer data protection and fair claims practices are under scrutiny; and for UnitedHealth, governance lapses tied to healthcare operations threaten long-term trust. As the sector evolves under increasing public and regulatory pressure, insurers that strengthen transparency, ethical oversight, and risk governance will be best positioned to sustain credibility and competitiveness in an ESG-driven market.

Reach out to SESAMm

TextReveal’s web data analysis of over five million public and private companies is essential for keeping tabs on ESG investment risks. To learn more about how you can analyze web data or to request a demo, reach out to one of our representatives.