Harnessing AI for Advanced ESG and SDG Analysis with TextReveal®

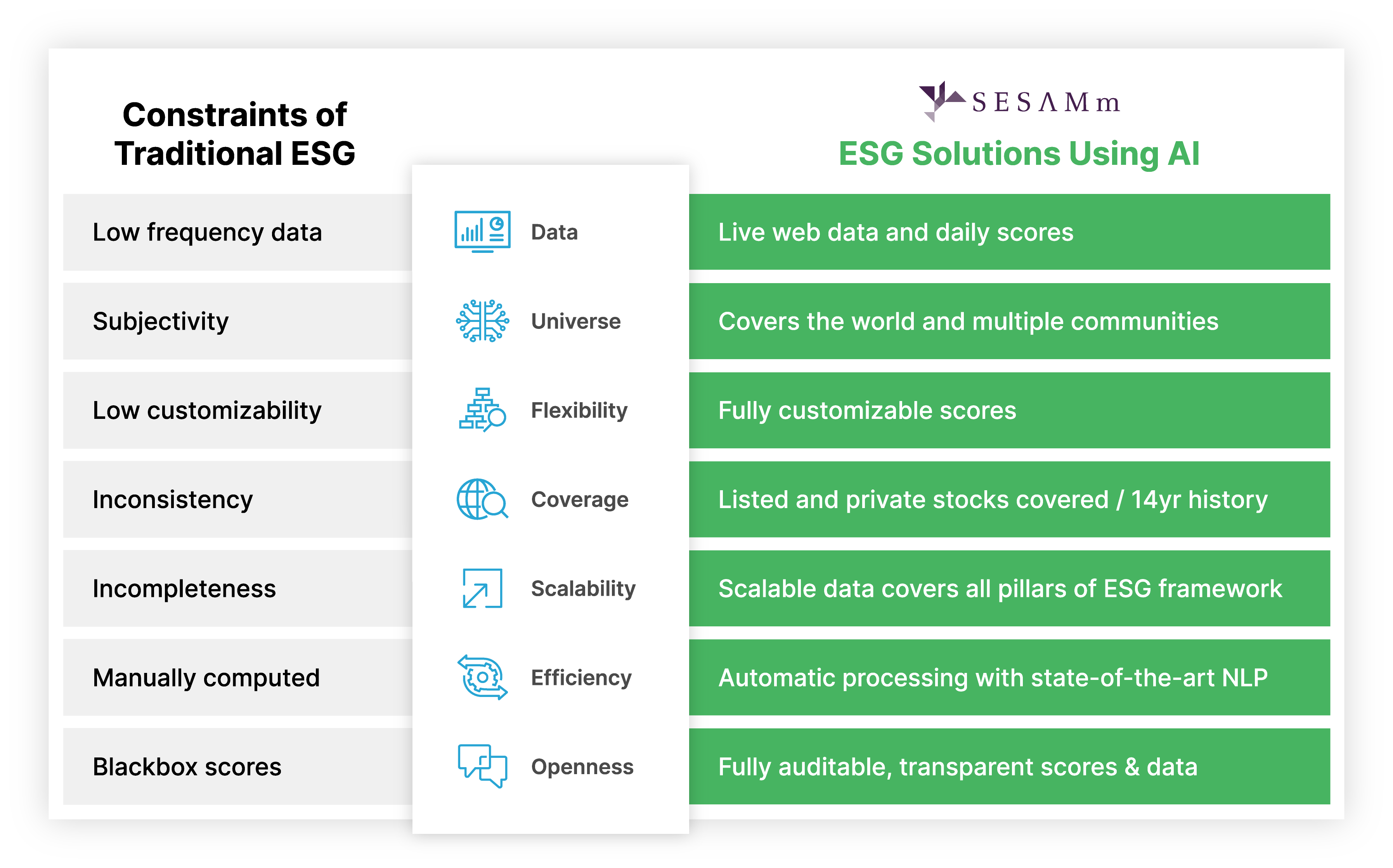

SESAMm revolutionizes the monitoring of ESG controversies and SDG (Sustainable Development Goals) positive impact events through its cutting-edge artificial intelligence platform, TextReveal®. Our tools are designed to empower asset managers, private equity firms, and corporations in sustainable investing, enabling them to increase ROI while effectively managing ESG risks and reducing potential losses.