In October 2022, this multinational integrated energy and petroleum company found itself in the crosshairs of two non-government organizations (NGOs), accusing it of "exploiting a gas field used to manufacture kerosene used by Russian planes in their bombings in Ukraine," according to the French daily Le Monde. The accusations expressly point out the 16 March 2022 strike, which killed around 600 civilians taking shelter at a Mariupol theatre.

The company? TotalEnergies.

The NGOs? Razom We Stand (Ukraine) and Darwin Climax Coalitions (France).

Also, in October, TotalEnergies posted a third-quarter net profit amid these allegations. "The French group reported an adjusted net income of $9.86 billion, compared with $4.77 billion for the same period in 2021 and $9.8 billion in the second quarter of this year," per Reuters.

Should investors and asset and portfolio managers be concerned? Is this one instance of allegations a nothing burger, or is it a sign—one of many red flags—to evaluate? Let's find out in this edition of Alternative Data Trends: TotalEnergies.

Analyzing TotalEnergies's ESG and sentiment data

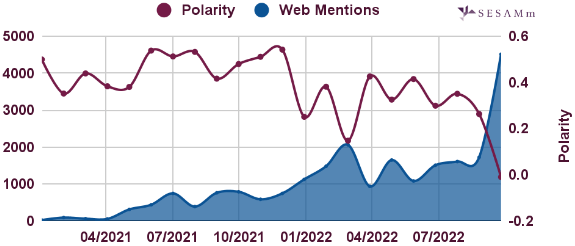

Company polarity and mentions volume

In the last year, mentions of TotalEnergies have gradually increased, spiking in March 2022. The spike in mentions coincides with a dip in the company's sentiment. These abrupt changes occurred when news broke about a lawsuit targeting TotalEnergies, claiming that the oil and gas group misled the public in its rebranding campaign, and a former French presidential candidate, Yannick Jadot, accused TotalEnergies of being complicit in war crimes.

After the spike in controversies in March 2022, TotalEnergies's web mentions continued to increase. And as a reflection of the mentions volume increases, the company's polarity decreases, moving in the direction of negative sentiment. News events triggering these movements include the legal case for allegedly fuelling Russian bombers and refinery strikes over wages.

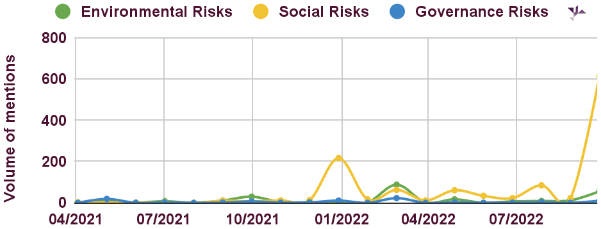

ESG risks

A screening of TotalEnergies's ESG risks uncovers a similar trend. For example, our platform detects an increase in social risks as early as January 2022. This signal coincides with the company's exit from Myanmar because of human rights abuses.

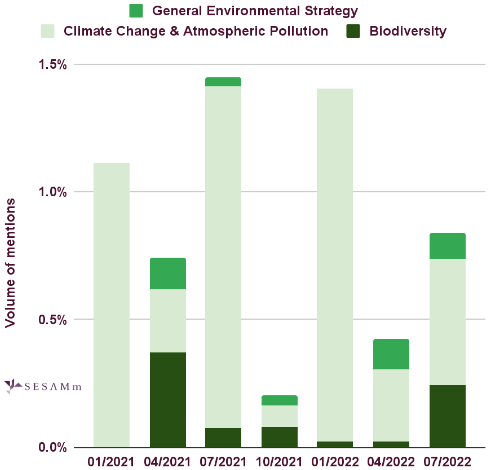

Examining TotalEnergies's environmental risks

Environmental-related mentions volume

Let's take a closer look at TotalEnergies's environmental risks, specifically for general environmental strategy, climate change and atmospheric pollution, and biodiversity. The topic of climate change and atmospheric pollution takes the largest share of mentions. Web data driving this volume include:

- Accusations of downplaying climate risks

- TotalEnergies sued for alleged greenwashing.

- Investors pressuring TotalEnergies to align with the Paris Climate Agreement

- Pan-African civil society pressures TotalEnergies to halt EACOP

- Oil leak at TotalEnergies in Antwerp

- Paris and New York join climate litigation against TotalEnergies.

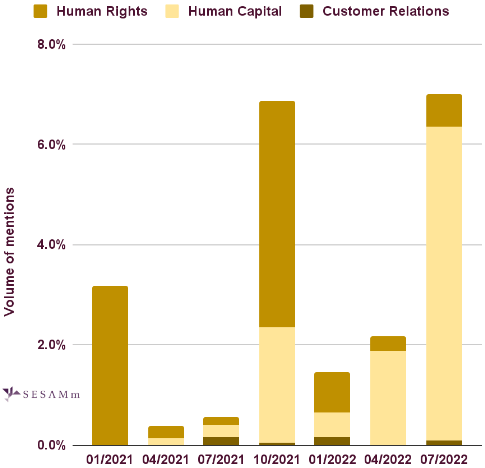

Studying TotalEnergies's social risks

Social-related mentions volume

TotalEnergies's social risks reveal even more controversies, looking at human rights, human capital, and customer relations topics. Human rights and human capital topics almost equally dominate topic mentions. Controversies highlighting the human rights topic include:

- Total and Le Drian turn a blind eye to a torture center in Yemen.

- Lawsuits regarding affiliations with oil projects in East Africa linked to the eviction of more than 100,000 people.

- And more.

Human capital topic controversies include:

- Multiple strikes on TotalEnergies's UK offshore platforms

- French union calls all-out strike for wages at TotalEnergies

Gauging TotalEnergies's governance risks

Governance-related mentions volume

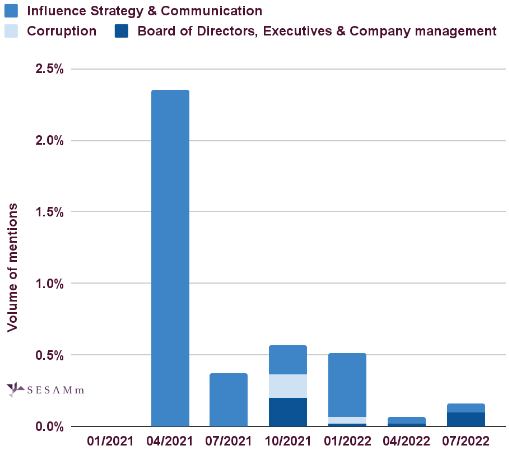

Finally, let's look at TotalEnergies's governance risk, specifically within topics for influence strategy and communication, corruption, and board of directors (executive and company management). The influence strategy and communication topic dominates the mentions volume. These controversies relate to greenwashing, such as:

- Protests due to false claims regarding the company's transition to a "zero oil platform"

- Clashes with Greenpeace over 'inaccurate' greenwash claims

- Controversial rebranding

- Downplaying climate risks

- Misleading commercial practices

Recapping TotalEnergies's ESG risks and public perception

We only scratched the web data surface for information on TotalEnergies, but even with this overview, you can probably see a pattern. Should investors, asset managers, and portfolio managers be concerned about the latest allegations against TotalEnergies? Maybe. At the very least, the data shows you should dig into the research and ask more questions to mitigate any risks in your portfolio companies.

Reach out to SESAMm

SESAMm is a leading NLP technology company serving global investment firms, corporations, and investors, such as private equity firms, hedge funds, and other asset management firms, by providing datasets or NLP capabilities to generate their own alternative data for use cases, such as ESG and SDG, sentiment, private equity due diligence, corporation studies, and more.

For questions, access to the full report, or to request a TextReveal® demo, contact us here: