In recent years, consumers have become increasingly conscious about the impact of their purchases on the environment and society. As a result, many companies have jumped on the bandwagon of sustainability and green initiatives to attract consumers who prioritize ethical and environmentally friendly products. However, not all companies are authentic in their claims and practices, leading to a phenomenon known as greenwashing. In the first article of this two-part series, we gave an in-depth analysis of reputational laundering and greenwashing. In this article, we will explore the prevalence of greenwashing across various industries. We will also study the case of a company practicing greenwashing and a genuinely sustainable company.

Reputational Laundering by Industry

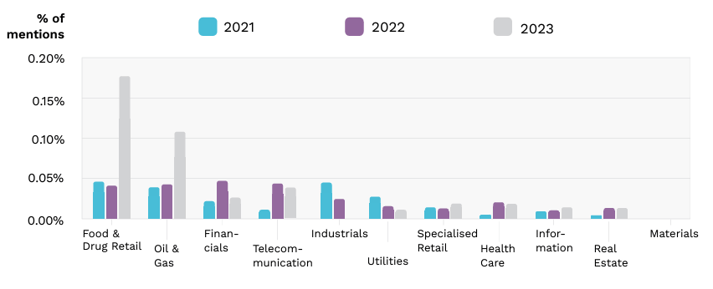

Reputational laundering is a common practice across various industries. Traditionally, the ‘Oil and Gas’ and ‘Financial’ industries have been identified as the main culprits. However, we have recently observed a substantial increase in the frequency of mentions in the ‘Food & Drug Retail’ industry, surpassing all other sectors by a significant margin. To evaluate this trend, we calculated the percentage of reputational laundering mentions in relation to the total number of mentions for each industry.

Reputational laundering over time

We looked at the last three years to find how each industry has evolved. Most industries have remained fairly static within a reasonable range. However, ‘Industrials’ have seen a significant decrease in mentions. Conversely, ‘Oil and Gas’ and ‘Food & Drug Retail’ significantly increased in 2023.

‘Food & Drug Retail’ more than tripled its mentions percentage due to a large number of mislabeled eco-friendly products (Walmart & Kohl’s) and green initiatives claims (Coca-Cola, Unilever, Amazon…).

The ‘Oil and Gas’ industry ranked second, and its recent spike can be associated mainly with greenwashing on actions such as their direct negative impact on the environment and the impact on local communities (TotalEnergies - Uganda & Tanzania). Another example is related to sportswashing with ‘Oil and Gas’ advertising heavily in sports events and even sponsoring sports clubs.

The financial industry has seen a decrease in mentions in 2023. However, its overall numbers are still significant. Most mentions we found were related to their investment activities in fossil fuels (HSBC to stop funding new oil and gas fields after greenwashing criticism. Goldman Sachs Facing SEC Probe of ESG Funds in Asset Management).

Figure 1: Reputation laundering by industry over time.

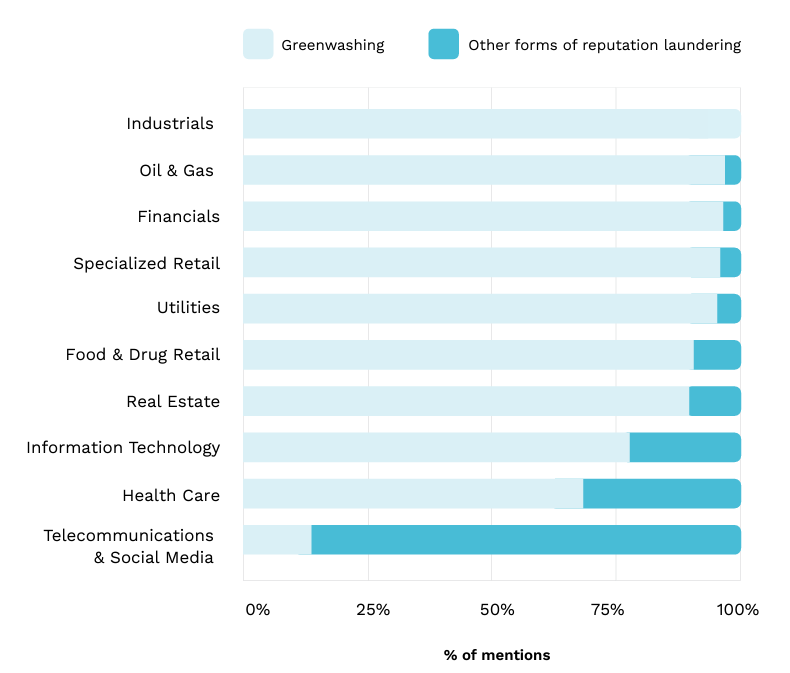

When examining the prevalence of reputational risks across sectors, greenwashing is the predominant concern in most industries. This is particularly evident in sectors like Industrials, Oil & Gas, and Financials, where greenwashing mentions are especially prominent. On the other hand, Telecommunications & Social Media stands out as an exception, with the bulk of its mentions skewing towards colorwashing, which encompasses specific practices such as blackwashing and sportswashing (Netflix accused of 'blackwashing' new docu-series Queen Cleopatra by casting black British actress).

Figure 2: Reputational laundering breakdown by industry.

- Oil & Gas: Oil Majors Shell and BP Accused of Greenwashing by Greenpeace, Research Reveals Minimal Renewable Energy Generation and Inadequate Investments – Technology Solutions for Home (itsforhome.com)

- Food & Retail: Costco class action claims retailer falsely advertises cranberry juice as containing no preservatives - Top Class Actions

Kellogg beats claims it falsely advertised ‘veggie’ Morningstar meatless products - Top Class Actions

Costco, Dreyer's ice cream bar class actions over false advertising claims dismissed - Top Class Actions

Walmart class action alleges company misleads consumers over amount of olive oil in mayonnaise - Top Class Actions - Financials: SEC sanctions Deutsche Bank for greenwashing, AML violations | Investment Executive

Use Case: Focus on the Financial Industry

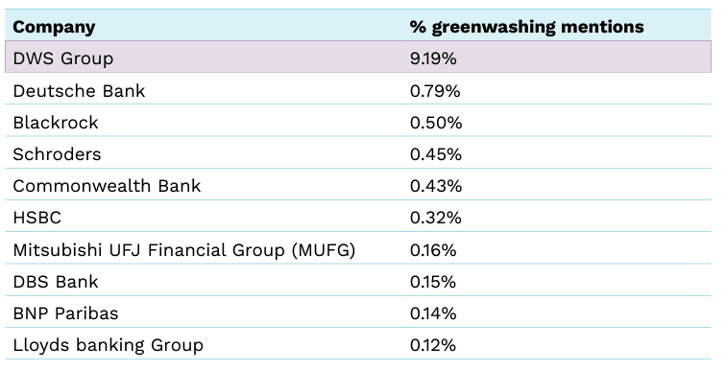

The financial industry's footprint in reputational laundering might not be the most pronounced in terms of direct mentions, but its influence stretches wide via its investment activities in other sectors. This means the ripple effect of the financial sector's actions can be substantially more impactful than those in other industries. Our investigation into this phenomenon included a rigorous examination of the frequency with which financial institutions are cited in discussions of greenwashing. Additionally, we assessed their efforts in driving positive impact initiatives. We scrutinized a group of 144 financial entities, arranging them on a scale from the greatest to the least number of greenwashing mentions in proportion to their overall volume of mentions.

Top financial firms by greenwashing claims

Below, we listed the financial firms with the highest relative volume of greenwashing mentions. Beyond the first two institutions on the list, which are related and had a big scandal in 2022, we can see many very recognizable names, such as Blackrock (investing in fossil fuels), JP Morgan (for fossil fuel investment policies), and HSBC (false advertising green claims) making our top ten list.

Case Study: DWS Group

The DWS Group, previously known as Deutsche Asset Management, found itself in the spotlight for all the wrong reasons in 2022 and 2023. The scandal landed them at the top of our list, a position highlighted by the significant number of mentions they received — a figure that is an order of magnitude higher than that of any other entity on the list.

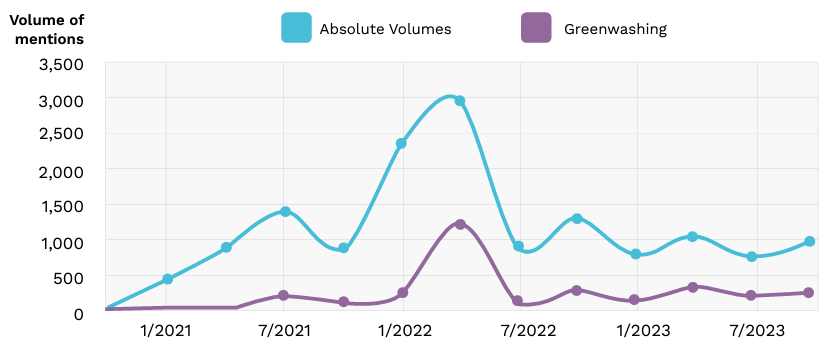

As a German asset management firm under the umbrella of Deutsche Bank, DWS was embroiled in severe greenwashing allegations. The last two years were marked by high-drama events: starting with greenwashing allegations at the end of 2021, their offices were searched in May 2022, which led to the resignation of the DWS chief in June 2022. The saga concluded with a substantial $25 million fine paid to U.S. regulators in September 2023.

The accompanying chart provides a visual representation of the timeline for these events, contrasting the number of absolute mentions with those specifically related to greenwashing. The alignment in the timing and scale of these mentions with the unfolding events is unmistakable.

Figure 3: DWS Group relative greenwashing mentions.

Best-in-class companies

In our effort to wrap up our study on an optimistic note, it's important to recognize that the heightened scrutiny of greenwashing and its associated initiatives ultimately serves a beneficial role by significantly raising our collective consciousness about crucial ESG issues.

While it's true that numerous companies have come under fire for greenwashing, it's equally important to highlight those that are genuinely advancing initiatives with positive environmental and social repercussions across the globe.

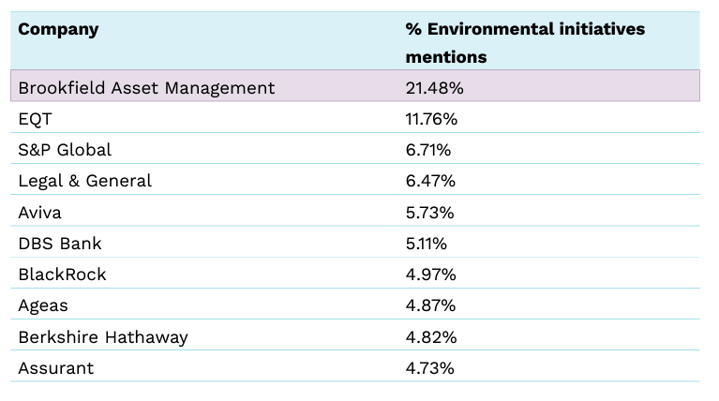

Employing the same method used to scrutinize financial firms implicated in greenwashing, we focused on the same group of 144 companies, honing in on the top 10 that stood out based on normalized mentions of their positive environmental actions.

The findings are quite encouraging: mentions of these positive initiatives dwarf those of negative impacts when viewed as a proportion of total mentions. Brookfield Asset Management (Brookfield) shines as the most notable, garnering almost double the mentions of its closest peer.

Also noteworthy is BlackRock's appearance on this list. Despite its presence on the greenwashing list, BlackRock has made strides in positive efforts, too. The company's initiatives—some counterbalancing the negative—have received more attention for their positive impact than for greenwashing, suggesting a complex but proactive ESG engagement.

Furthermore, companies like EQT, Berkshire Hathaway, and Standard & Poor's have actively engaged in initiatives that drive positive impact, earning them significant—and rightfully so—media coverage.

Case Study: Brookfield Asset Management

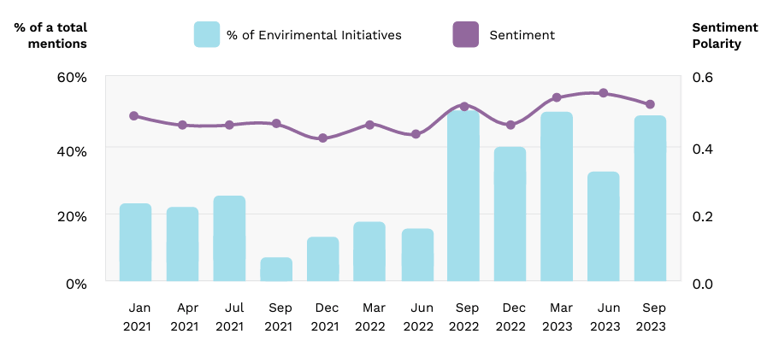

Brookfield's presence on our top 10 list is well-founded, reflecting the substantial conversation around their significant efforts in environmental sustainability. The company has undertaken numerous initiatives aimed at reducing its ecological impact. These include launching a $7 Billion Global Energy Transition Fund, collaboration on a sustainable neighborhood project in Texas, a commitment to planting thousands of trees, and the transition to zero-emission electricity in their offices.

Figure 4: Brookfield sentiment vs environmental initiatives.

In terms of visibility, these environmental initiatives represent a significant portion of the company’s profile, surpassing 50% of total mentions in September 2022. This highlights the dominant role these actions play in the public discourse surrounding Brookfield.

The company’s polarity(1) — a measure of sentiment in mentions — shows a steady and positive trajectory beginning in late 2021. This trend points to a growing positive reputation and increased positive online discussions regarding the company.

Web Sentiment Analysis: Financial Industry vs. DWS & Brookfield

Figure 5: Sentiment over time.

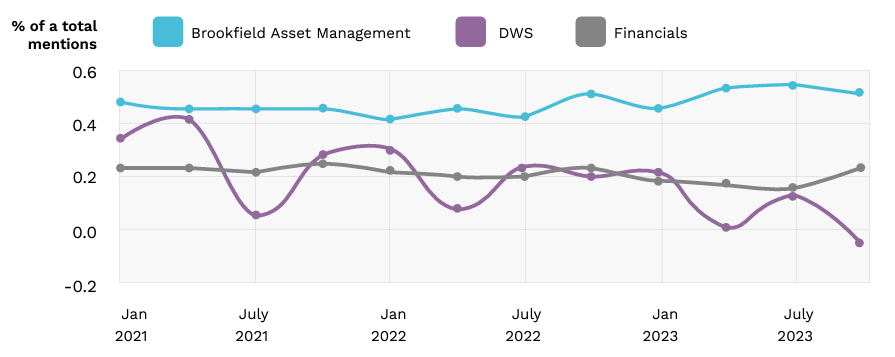

When assessing the landscape of ESG engagement within the financial sector, we consider the comparative reputations of two key players: the leader in positive impact initiatives against the firm with the highest number of greenwashing mentions. How do they stack up against the broader sentiment within the financial industry?

The finance industry at large grapples with a challenging reputation shaped by various issues, including regulatory shortcomings, perceived corporate greed, opacity, and environmental impacts, among others.

Against this backdrop, we observe that:

DWS: The company's reputation trajectory is on a downward slope compared to the industry average, with the aftereffects of recent controversies culminating in a reputation low as of October 2023.

Brookfield: In contrast, Brookfield's commitment to the environment appears to buoy its reputation, maintaining a consistently positive trend that surpasses the market standard. Notably, from January 2023 onward, there is a discernible uptick in positive sentiment.

Conclusion

While the prevalence of greenwashing poses a considerable challenge within the corporate sphere, our study reveals a silver lining. The intensive scrutiny and debate surrounding environmental, social, and governance (ESG) issues have led to heightened awareness and, more importantly, action. Amidst the cacophony of claims, our analysis has found a discernible pattern of positive ESG initiatives overshadowing negative impacts, indicating a shift towards genuine sustainability efforts.

Particularly encouraging is the performance of certain frontrunners like Brookfield Asset Management, which has emerged as a beacon of positive action, outpacing its peers in driving meaningful change. This illustrates the potential for firms to lead by example and underscores the importance of rigorous analysis in distinguishing substantive ESG commitments from superficial ones.

Ultimately, this study underscores the transformative power of informed scrutiny and the pivotal role that advanced analytical tools play in propelling the ESG agenda forward. As the financial community continues to refine its approaches to evaluating ESG metrics, we can remain cautiously optimistic about the journey from mere green-tinted narratives to deeply rooted, impactful corporate practices.

(1) Polarity aggregates positive and negative sentiment (opinions, reviews) on a company. It ranges from -1 to 1. A 0 score means that positive and negative sentiment are equal. Well-regarded brands generally have polarity scores over 0.5.

At SESAMm, we used AI to study billions of articles and analyze greenwashing trends. Download this comprehensive ebook for an in-depth understanding of the evolving landscape of reputational laundering, notably greenwashing, and dive into its trends in the corporate world.

SESAMm’s AI Technology Reveals ESG Insights

Discover unparalleled insights into ESG controversies, risks, and opportunities across industries. Learn more about how SESAMm can help you analyze millions of private and public companies using AI-powered text analysis tools.