As the 2022 United Nations Climate Change Conference wraps up, governments and, by proxy, companies are charged with fulfilling new recommendations, especially for non-State entities to commit with integrity to Net-Zero. COP27, as the conference is also called, is the time and place where we claim as a united society at the world's center to make change for the better.

But COP27 is over. Now what? Do we go back to business as usual? Do we wait and see if we stick to any of these new agreements? Or worse, do we say we'll make changes but fall short of making those changes?

I say no. We can do better, and here's why…

We need to talk about climate change

Climate change effects are more than global warming. Global warming consequences include:

- Rising sea levels

- Stronger and more intense hurricanes

- More droughts and heat waves

- Longer wildfire seasons

- And more

Why do I bring these up? Because all of these effects will impact your business in one way or another.

For example, did you know that the Rhine River, one of Europe's major rivers, is suffering from drought? Water levels are so low that barges are limited, and it's disrupted river cruises because levels are currently 38 centimeters below the minimum required.

The same goes for the Mississippi River in the U.S. The Mississippi River has dropped to the lowest levels they've ever been in 34 years, driving up shipping costs. This challenge is also a big deal because the river carries 92% of agricultural exports.

Also, in the past year, damaging hurricanes and typhoons have damaged infrastructure in South Korea, South Africa, China, Japan, and the U.S., to name a few countries, affecting crops, manufacturing operations, supply chains, and much more across the globe.

I could go on about how each effect influences enterprise, but the bottom line is climate change is bad for business. And supporting companies that enable climate change is also bad for business, which brings us to the topic of environmental, social, and governance (ESG) measures.

We need to talk about ESG

ESG has become mainstream since the UN shared a report in 2006, a joint initiative by a group of financial institutions to develop policies and guidance on how to better incorporate ESG issues in securities brokerage services, asset management, and associated research functions. This introduction has helped industries establish goals through:

- Managing ESG risks

- Anticipating regulatory action or accessing new markets

- Contributing to the sustainable development of their societies

However, with ESG policies come ESG data challenges. For example, ESG measuring, its data, and how companies report them are inconsistent. ESG data providers deal with "data gaps" differently, so their approaches can lead to discrepancies. And as ESG data becomes available publicly, how ESG data providers interpret the data varies, too.

We need to talk about greenwashing

In simplest terms, greenwashing occurs when a company misleads its stakeholders, investors, and consumers about its environmental practices, specifically by communicating positive environmental performance contrary to its actual, less flattering execution.

On the surface, you might think, "What's the big deal? We all exaggerate, right?" But as sustainability awareness among investors and eco-conscious customers grows, so has their scrutiny over business conduct to disclose information about a company's performance and its "environmental-friendly" products. Their scrutiny, coupled with the growing number of companies reporting their environmental footprints, reveals that many companies misreport and publish information about their ecological impacts, which regulators consider misleading or deceptive.

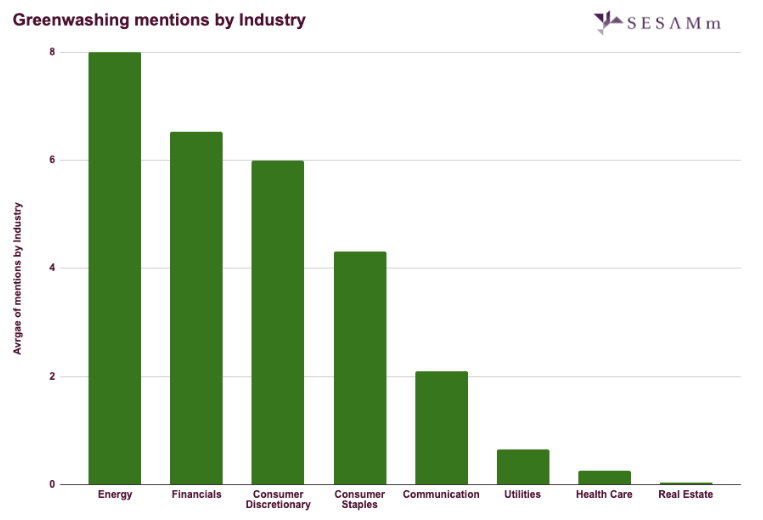

How do we know? Let's take a look at greenwashing mentions by industry.

We analyzed greenwashing mentions in web data. On the X-axis, we list the industries. The Y-axis measures the ratio of greenwashing mentions by N° of companies per industry (N=1166 companies) since 2015; this extraction method corrects sampling bias. Each industry is defined by a significant sample of large- and mid-capitalization-sized companies in developed countries.

This greenwashing mention chart clearly shows that the Energy industry has the highest ratio of greenwashing allegations. While many fossil fuel companies claim to be transitioning into clean energy, most mentions link these companies to advertisements and campaigns that don't align with the Paris Agreement goals. In contrast, fossil fuel companies are growing their carbon-intensive operations and products. It's a concerning trend because according to The Intergovernmental Panel on Climate Change (IPCC) report, "Climate Change 2021: The Physical Science Basis.", the data shows that emissions from fossil fuels are the primary cause of global warming, contributing up to 91% of global carbon dioxide emissions in 2018 as an example.

Second, on this chart is the Financial industry. It has fallen short of its commitments to climate action while continuing to finance fossil fuels. According to eMarketer, financial institutions have allocated $4.6 trillion for fossil fuels while promoting sustainable finance and supporting global energy transition.

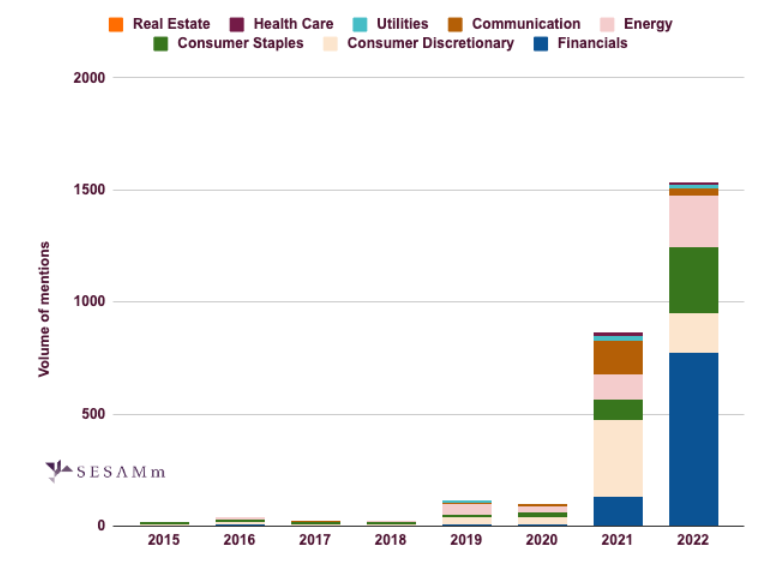

Further, the mentions volume has grown year over year since 2015—when it was almost zero—to more than 1500 present day.

Clearly, this greenwashing problem is getting worse. So what can we do about it?

We need to talk about a solution

We don't have any control over what companies will do to fulfill their agreements, but we can understand their ESG data better and make better investment and portfolio decisions.

How? With AI.

AI, specifically natural language processing (NLP) algorithms, help us read billions of news articles, forums, and web text and extract unstructured data for analysis. With SESAMm's TextReveal®, we can see an entity's ESG controversies or events in near real time, providing a unique perspective to ESG data and details, filling the data gaps more accurately.

So when Company A reports on its ESG goals, we can help verify if the results are accurate and find any potential controversies that didn't make the report. We also don't need to wait until ESG reports come out; we can extract this data from the web on an as-needed basis. Moreover, we can look at all types of companies across the globe, public or private. As long as web data exists for an entity (or concept), we can analyze it.

My final thoughts

COP27 might be over, but our agreements and commitments carry on. We have an opportunity today to make a positive difference toward climate change while still maintaining profits. In fact, I think we can be even more profitable if we support green and sustainable initiatives.

I'd like to hear your thoughts; feel free to reach out on LinkedIn and share them with me.

About Alexandre Tiesset

Alexandre Tiesset is the Head of ESG at SESAMm. He's worked in finance for seven years in various ESG-related roles, such as Credit Analyst, Sustainable Investing Specialist, Index Product Specialist, and more. He holds a Master of Science degree in Finance and Financial Analysis. His passion lies in the intersection of finance and general knowledge and making new connections.

Reach out to SESAMm

SESAMm is a leading NLP technology company serving global investment firms, corporations, and investors, such as private equity firms, hedge funds, and other asset management firms, by providing datasets or NLP capabilities to generate their own alternative data for use cases, such as ESG and SDG, sentiment, private equity due diligence, corporation studies, and more.

To learn how you can generate NLP-enhanced ESG data for your firm, or to request a demo, reach out today.