Introduction

Today, environmental, social, and governance (ESG) criteria have become critical in shaping companies' operational and strategic directions. As organizations strive to align with the United Nation’s sustainable development goals (SDG), understanding the variances in ESG performances across different geographical regions becomes crucial. This article explores ESG discrepancies in North America, Latin America, Europe, Australia, Asia Pacific, and Emerging Countries. By dissecting the prevalent ESG risks and illustrating the distribution of SDG adverse behaviors within these regions, we aim to provide a granular analysis that not only highlights regional challenges but also paves the way for tailored strategic frameworks. This nuanced approach facilitates an informed assessment of disparities, empowering stakeholders to craft effective and regionally nuanced strategies.

ESG Overview: A Regional Perspective

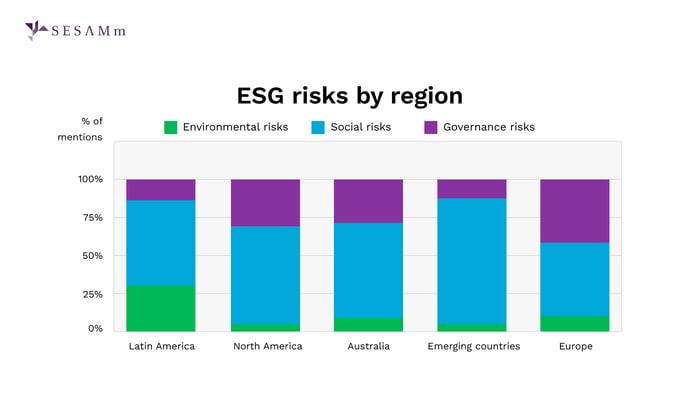

Upon standardizing data across the examined regions, our analysis unveiled a predominance of social risks across the board. Yet, the regional specificities unveil the complexity of global ESG landscapes.

Fig 1: ESG Risks by region

Upon standardizing data across the examined regions, our analysis unveiled a predominance of social risks across the board. Yet, the regional specificities unveil the complexity of global ESG landscapes.

Latin America is markedly affected by environmental risks, underscored by legal actions against companies for endangering biodiversity. Legal battles over toxic spills, water contamination, and ecosystem-threatening activities vividly portray this region's environmental challenges.

Europe emerges as a hotbed for governance-related risks, particularly emphasizing influence strategy and communication. European companies find themselves at the correlation of controversies ranging from greenwashing and emissions cheating to governance failures, spotlighting the complex governance terrain they navigate.

While grappling with governance risks, North America and Australia exhibit unique profiles. North American firms face various governance challenges, from securities fraud to greenwashing, painting a complex picture of corporate governance in the region. Australian companies are likewise embroiled in governance concerns, predominantly linked to senior management and regulatory compliance, reflecting the governance trials specific to the Australian context.

Emerging countries highlight the prevalence of social controversies, from human rights violations to labor rights concerns, underlining these regions' social complexities.

This multifaceted overview underscores the broad spectrum of ESG risks while illuminating the distinctive challenges faced by each region.

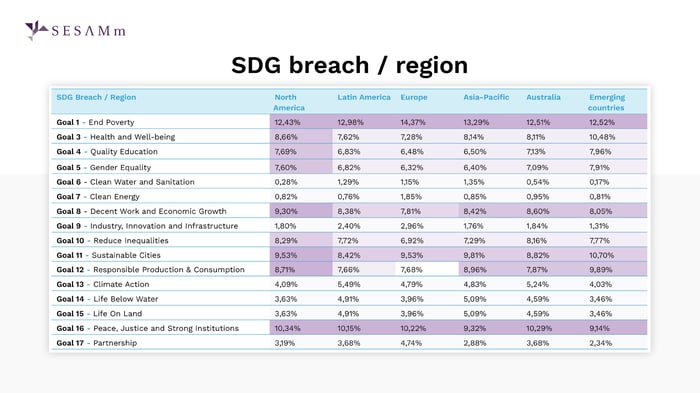

UNSDG Adverse Behaviors: Regional Breakdown

When looking at UNSDG adverse behaviors for the same regions, we find regional trends and more generalized ones. For example, Goal 1, “End Poverty,” displays one of the highest breach rates of all the goals. Whereas Goal 6 - Clean Water and Sanitation, displays interesting discrepancies, mainly exposing differences between developed and developing countries.

The table below provides a detailed comparison of SDG adverse behaviors across regions, categorizing them by specific goals to highlight regional differences in SDG challenges.

Fig 2: SDG breach/region

Goal 1, "End Poverty," is the most prevalent SDG issue across all areas. Europe is experiencing the most significant impact due to various factors, including labor rights issues, human capital concerns, governance challenges, anti-competitive practices, and tax controversies.

Similarly, Goal 16, "Peace, Justice, and Strong Institutions," underscores significant issues in North America related to human rights, labor, management integrity, anti-competitive actions, tax strategies, corruption, and shareholder matters, driven largely by flaws in the criminal justice system, including over-incarceration, racial bias, and police misconduct. These problems undermine public trust and equality, highlighting the need for governance improvements despite North America's strong institutional base.

Emerging countries face the greatest challenges with Goals 3 and 11, "Health & Well-being" and "Sustainable Cities," respectively, due to inadequate healthcare infrastructure, disease prevalence, limited healthcare access, poor sanitation, pollution, overcrowding, and substandard urban planning. Addressing these issues requires substantial healthcare, sanitation, and sustainable urban development investments to mitigate risks.

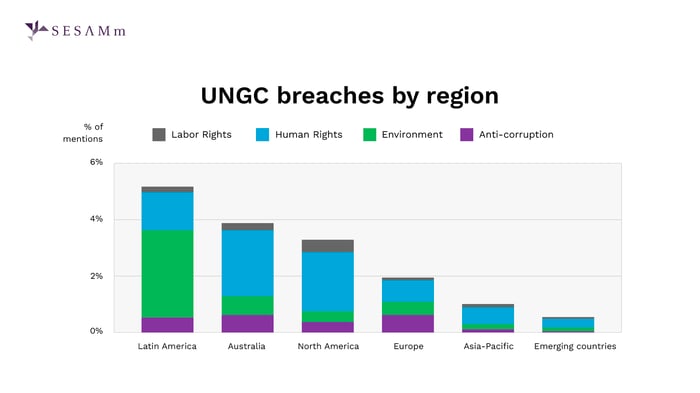

UNGC Controversies: A Regional Analysis

Our exploration extends to aligning ESG controversies with their respective regions and assessing the proportion of these risks aligning with breaches of the United Nations Global Compact (UNGC) principles.

Fig 3: UNGC breaches by region

Latin America emerges as the frontrunner in this evaluation, demonstrating a noteworthy prevalence of breaches, particularly within the environmental pillar. Notably, the focal point centers on environmental damages attributed mostly to mining and metals companies.

Australia is marked by a significant number of controversies surrounding human rights violations. These encompass various instances, ranging from privacy breaches and infringements on the right to security and dignity and diversity & inclusion. These incidents have garnered considerable attention, contributing to the heightened significance of regional human rights breaches.

In North America, despite a considerable share of human rights breaches, it distinguishes itself by exhibiting the highest prevalence of labor rights violations. In contrast to other regions, North America faces a substantial number of lawsuits related to employment, particularly concerning diversity and inclusion breaches, including harassment lawsuits and instances of racial bias.

European companies distinguish themselves through notable instances of Anti-corruption pillar breaches, including multiple failures in money laundering investigations, legal actions resulting in lawsuits and fines, as well as settlements for bribery allegations and accusations of kickbacks.

Latin America's environmental controversies, Australia's human rights challenges, North America's labor rights issues, and Europe's anti-corruption breaches each tell a part of the global ESG narrative, demonstrating the diverse facets of regional ESG controversies.

Leveraging SESAMm for Insightful ESG Analysis

SESAMm's technology identifies and analyzes potential risks and controversies through our advanced AI-powered text analysis tool, providing essential insights for stakeholders. This capability is invaluable for organizations, particularly private equity firms and financial institutions, aiming to navigate ESG complexities. By leveraging SESAMm's insights, businesses can adapt their ESG strategies to their regional contexts' unique challenges and opportunities, ensuring global sustainable and responsible operations.

Conclusion

To summarize, this analysis underscores significant regional differences in ESG factors, with social risks emerging as a common concern worldwide. Yet, regional distinctions are evident: Latin America is particularly impacted by environmental issues, Europe grapples with governance risks, and emerging nations face a surge in social controversies. The detailed analysis of SDG adverse behaviors, organized by goals for each region, highlights these differences further. It is imperative for companies to recognize and adapt to these regional nuances in their ESG strategies, ensuring approaches are finely tuned to address the distinct risks and challenges prevalent in their specific operational environments.

SESAMm’s AI Technology Reveals ESG Insights

Discover unparalleled insights into ESG controversies, risks, and opportunities across industries. Learn more about how SESAMm can help you analyze millions of private and public companies using AI-powered text analysis tools.