Housing and construction fees have skyrocketed over the past few years. This increase goes back to multiple factors: economic unrest, raw materials disruption, and labor shortage, to name a few. What does web data have to say about all this?

In this week’s “Alternative Data Trends” issue, we’ll talk about commercial real estate, unveiling the industry’s ESG and SDG conformity and the effects of COVID-19 on the supply chain and labor.

Commercial real estate volume of mentions

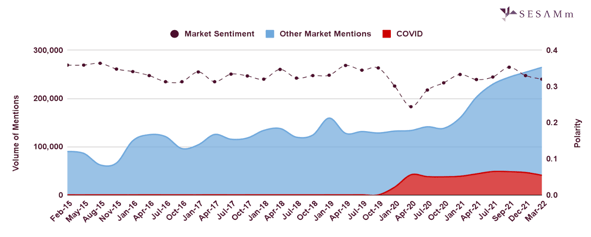

While analyzing web data dealing with commercial real estate, we detected an evident increase in the industry’s volume of mentions. This trend spiked in April 2020 and was initially hindered by the COVID pandemic, which resulted in a drop in sentiment polarity. Still, it witnessed a rapid recovery leveraging digitalization and e-solutions (Figure 1).

Figure 1: Commercial real estate market mentions Feb 2015 to Mar 2022.

Figure 1: Commercial real estate market mentions Feb 2015 to Mar 2022.

Case study: Unibail-Rodmaco-Westfield

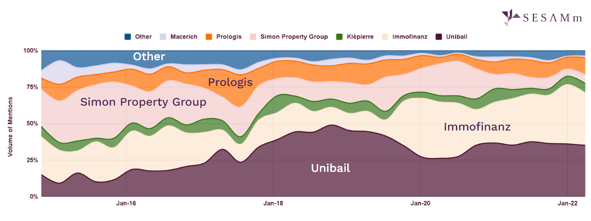

To further understand the commercial real estate industry, we studied Unibail-Rodamco-Westfield and its competitors. Unibail-Rodmaco, a French commercial real estate company, acquired Westfield, a U.S. company, in December 2017. This acquisition accentuated its market share and grew its web voice share compared to its competitors (Figure 2).

Figure 2: Unibail volume of mentions compared to the market.

Figure 2: Unibail volume of mentions compared to the market.

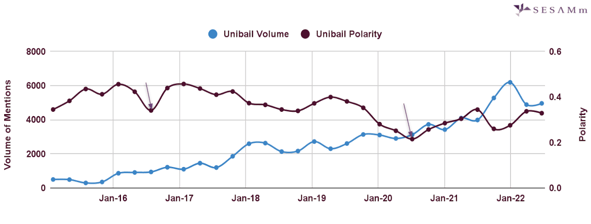

The chart in Figure 3 shows that the company’s volume of mentions has been increasing ever since the acquisition occurred. However, a negative sentiment polarity has been steadily increasing due to social ESG risks related to collective health crises during COVID and security-disrupting threats. In addition, the company faced difficulties collecting rent from retailers leading to lawsuits.

The arrows in this chart indicate Unibail ESG risks in time. The first arrow points to the social risks generated by security threats, in 2016, and the second arrow points to the issue of unpaid rent and lawsuits filed regarding the matter, in 2020.

Figure 3: Unibail ESG risks.

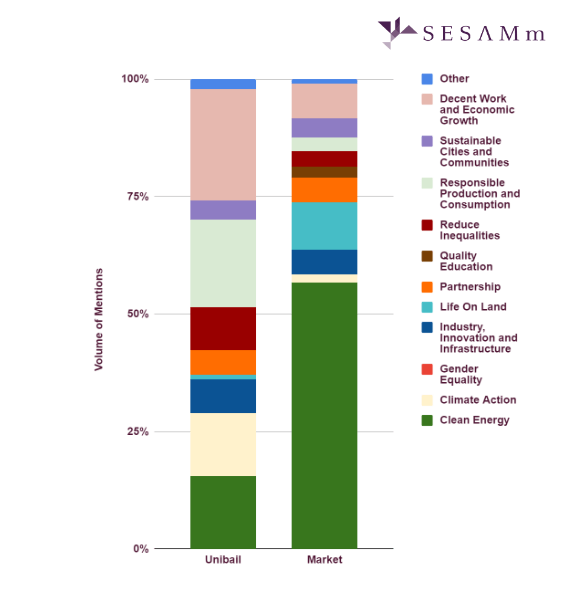

According to web data, Unibail has the second highest volume of sustainability mentions among analyzed groups. The company was notably related to sustainable development goals number 8* and number 12**. This volume is manifested in their initiatives to help unemployed people and maintain sustainable ethics and practices when launching their malls and shopping centers (Figure 4).

* Social development goal for decent work and economic growth.

** Social development goal for responsible consumption and production.

Figure 4: Unibail SDG volume of mentions compared to the market.

The impact of COVID on the emerging commercial real estate market

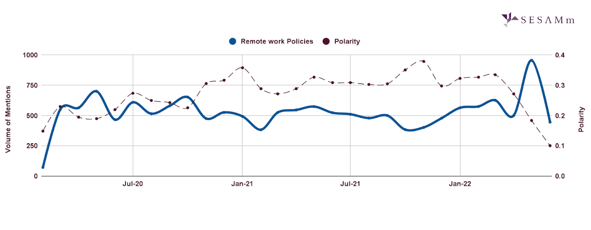

As previously mentioned, COVID had several effects on the industry, both negative and positive. Furthermore, it reshaped the market and its work policies. Some companies, as well, chose to switch to remote work and digitalization. In Figure 5, we can see that sentiment related to remote work policies has steadily improved since the pandemic started. However, in the last few months, we’ve seen a sharp decline, potentially signaling a negative reaction to some companies requiring employees back to their offices.

Figure 5: Remote work policies’ volume of mentions.

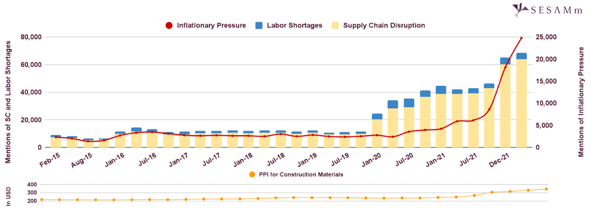

In addition, the pandemic has resulted in labor shortage and supply chain disruption, eventually leading to tremendous inflationary pressure. Raw materials prices, including oil, gas, iron, and wood, have witnessed a drastic increase and a disequilibrium between the volume of demand and the quantity available (Figure 6).

Figure 6: Labor shortage and supply chain disruption Feb 2015 - Dec 2021.

Data source

To produce this analysis, we combined natural language processing with billions of textual web data related to the real estate market, commercial real estate in particular. Using NLP-powered models gives us an edge as we can extract ESG, SDG, and financial insights that aren’t necessarily obvious or easy to detect. These insights help investors make better investment decisions.

SESAMm leverages artificial intelligence and machine learning to help you decipher and understand timely sentiments, trends, and ESG metrics on a wide range of public and private companies.

Stay in touch with SESAMm

Thanks for reading this issue of Alternative Data Trends. Be sure to catch the next issue by subscribing to our blog. And if you'd like a TextReveal® demo, send us a message via the form below.