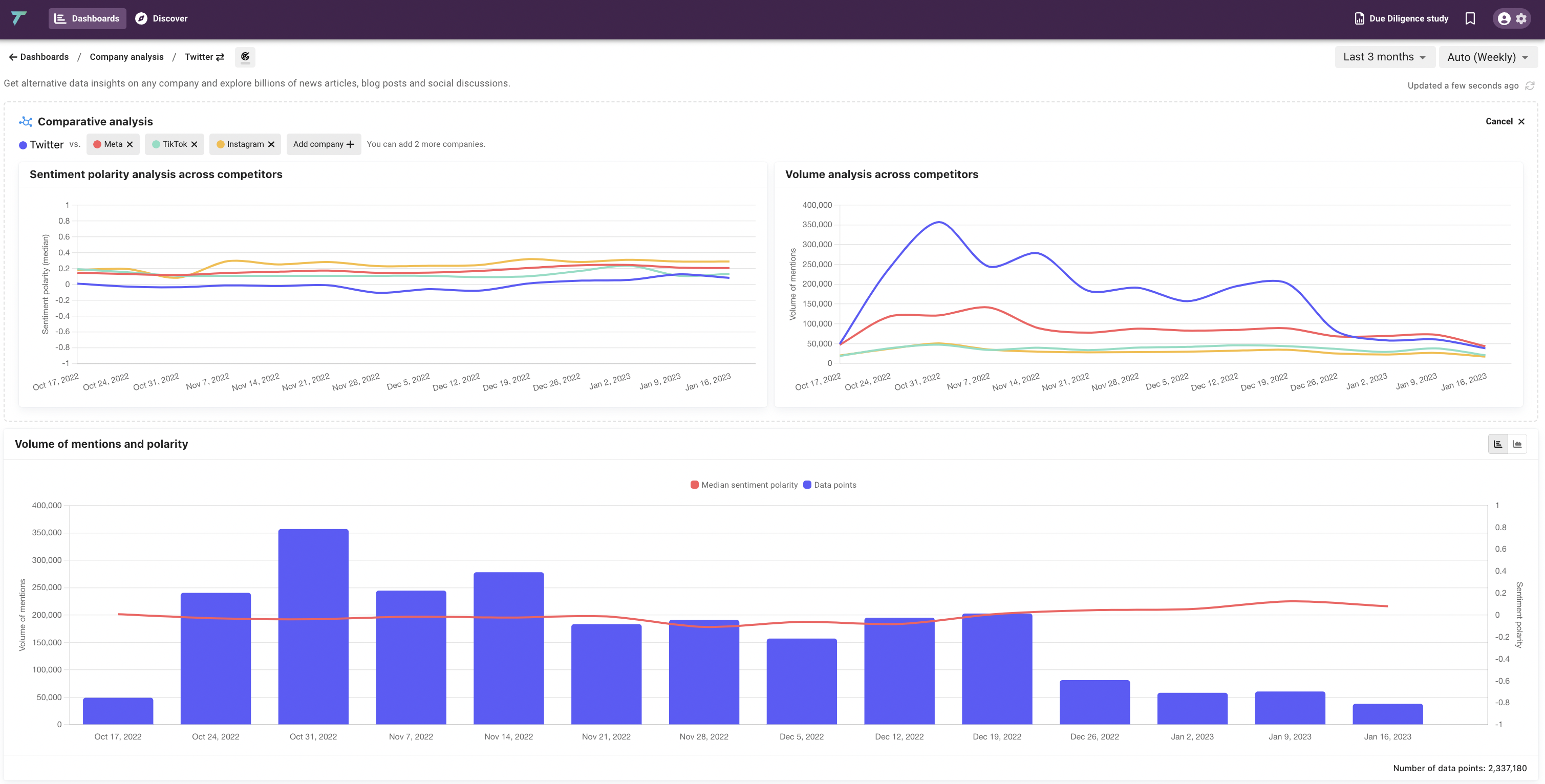

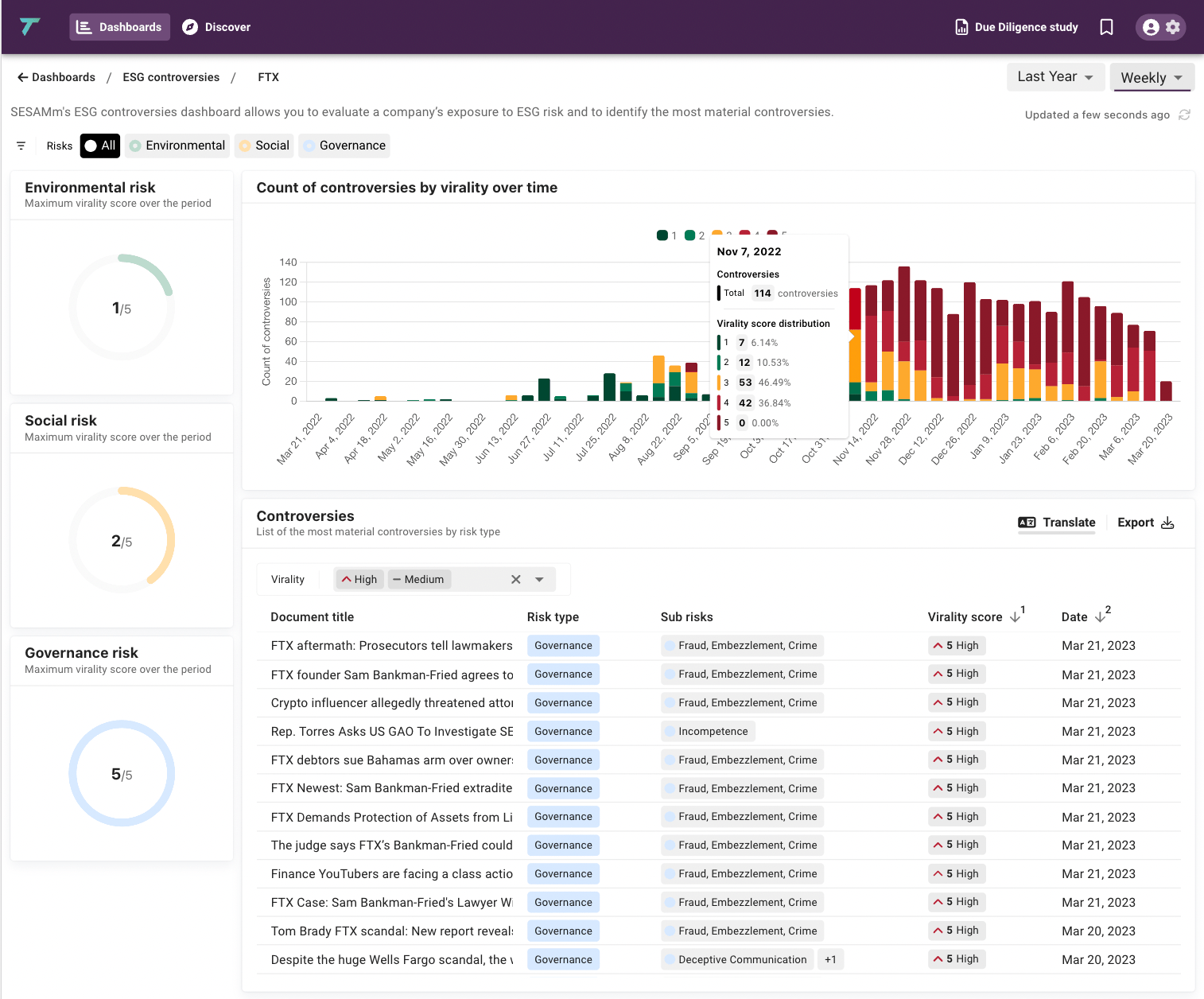

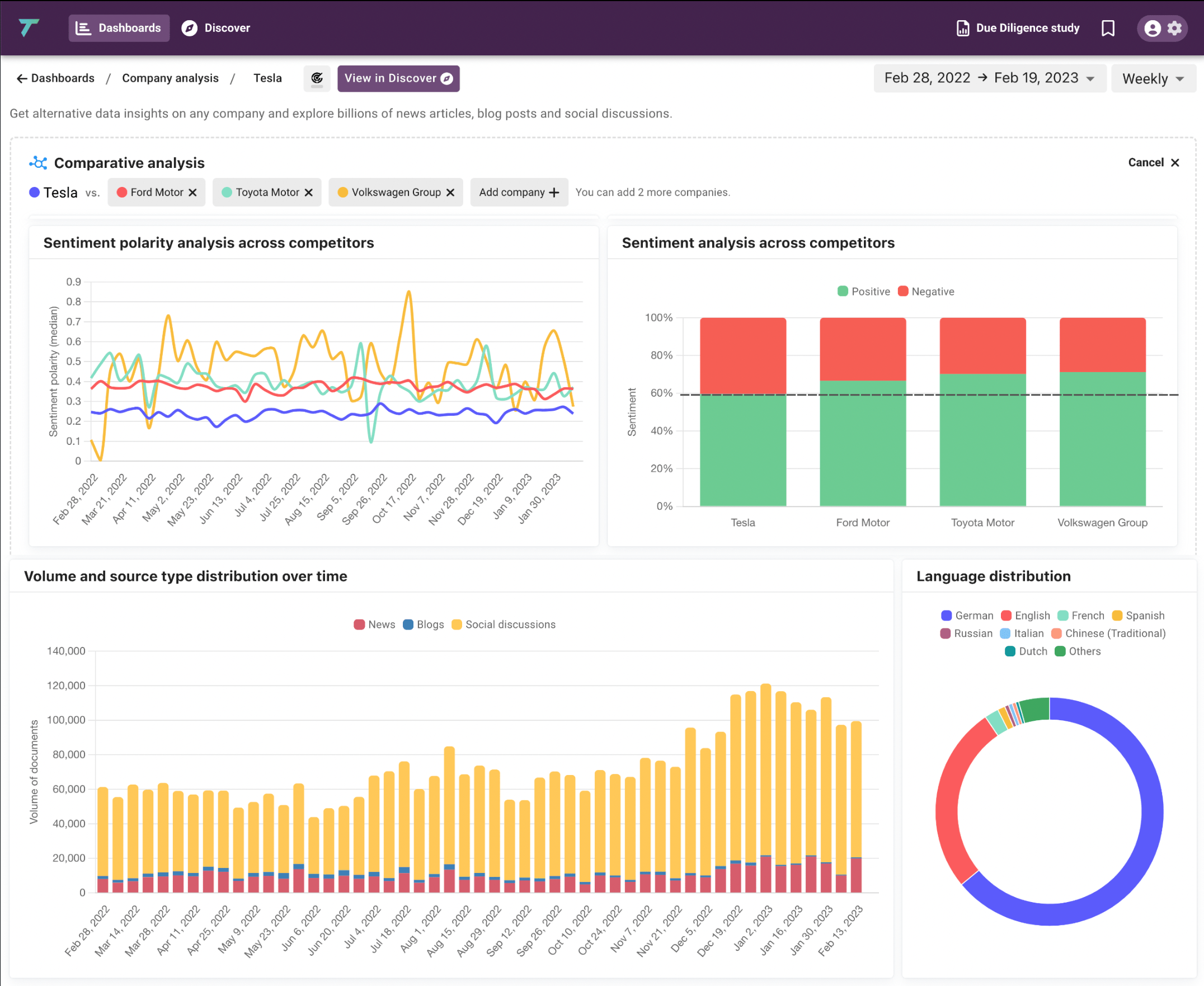

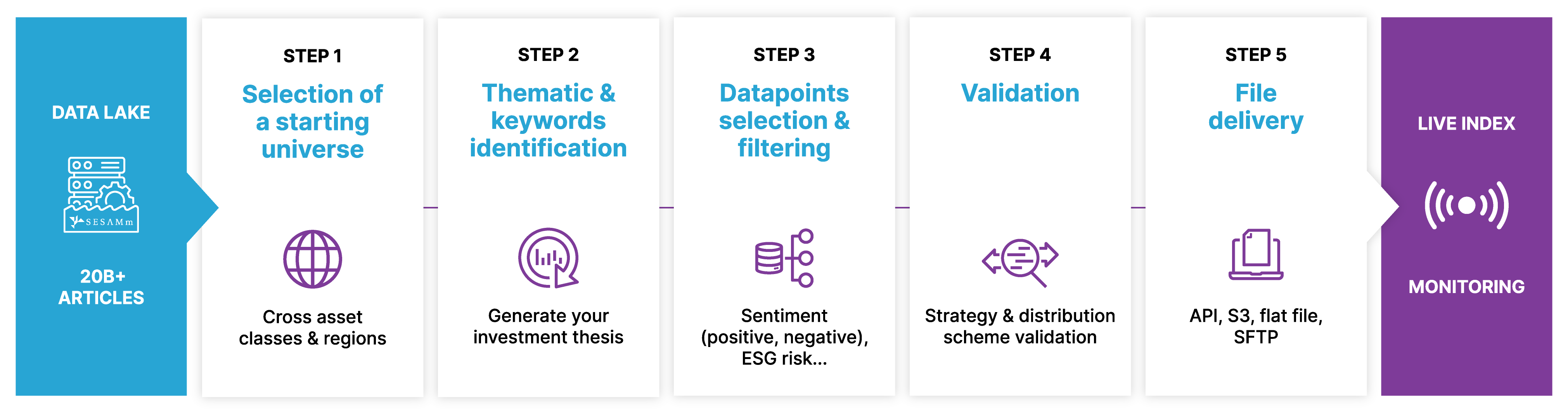

A massive data lake with the technology to filter only what’s relevant to your index

The most extensive coverage at your fingertips, consisting of a data lake of more than 20 billion articles, more than four million sources, and more than five million public and private companies, with topics in any country, region, or markets—developed, emerging, frontier (including small caps, high yield, and more)