May 2, 2022. The S&P 500 ousts Tesla, Inc. from the S&P 500 ESG Index. Tesla is widely recognized as the firm that ushered electric vehicle making into the mainstream. So the index’s move seems unreasonable or possibly made in error to many, raising some interesting questions:

- How does an environmentally-friendly corporation like Tesla get dropped from an ESG index?

- Why does a potentially non-environment-friendly company like Exxon make the ESG index and remain on it?

- What do these moves mean about the integrity and validity of ESG scores and ratings?

Before we go on, let’s bring some context.

Why did the S&P 500 ESG Index drop Tesla?

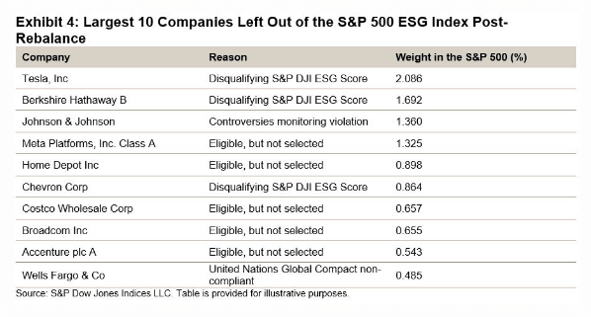

May 18, 2022. In an S&P blog post, "The (Re)Balancing Act of the S&P 500 ESG Index," a spokesperson announces and explains their decision. Here are the bullet points:

- Global industry group peers pushed Tesla’s S&P DJI ESG Score further down the ranks in the GICS industry group: Automobiles & Components.

- A decline in criteria level scores related to Tesla’s low carbon strategy and codes of business conduct contributed to its 2021 S&P DJI ESG Score.

- A media and stakeholder analysis identified "two separate events centered around claims of racial discrimination and poor working conditions at Tesla’s Fremont factory."

- The analysis also highlights "the handling of the NHTSA investigation after multiple deaths and injuries were linked to its autopilot vehicles, affecting the company’s S&P DJI ESG Score at the criteria level, and its overall score."

Companies, including Tesla, left out of the S&P 500 ESG Index post-rebalance. Image courtesy of Indexology Blog.

The S&P blog post summarizes their case about dropping Tesla, "While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens." And in this statement lies the crux of why the index dropped Tesla and why others are still on.

Analyzing Tesla’s web data

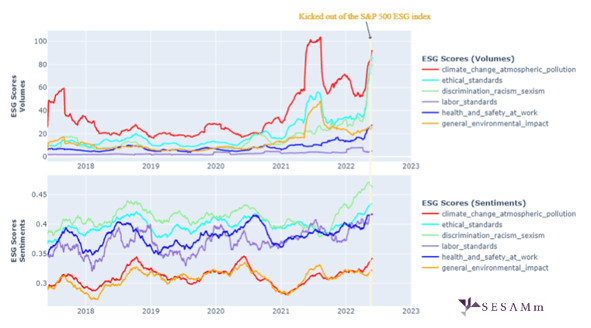

SESAMm’s TextReveal® insights suggest that the S&P 500’s decision to remove Tesla could be justified based on increasing controversy levels concerning discrimination, ethical standards, and work health and safety. By analyzing text related to ESG topics across the web, we picked up trends for the following subtopics:

- climate_change_atmospheric_pollution

- ethical_standards

- discrimination_racism_sexism

- labor_standards

- health_and_safety_at_work

- general_environmental_impact

Tesla’s ESG scores (six subtopics)

Figure 1: Tesla ESG scores for volumes and sentiments (1-year moving average), all source types.

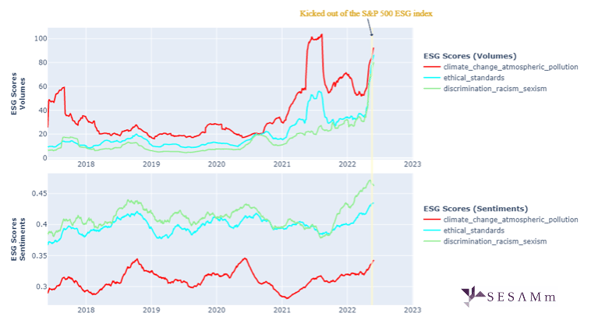

Regarding the volume features (Figure 1), we observed a significant increase in the scores related to ethical standards, discrimination, and atmospheric pollution for Tesla before the controversy. The conclusions are mostly the same for ESG sentiment (negative) scores. An interesting note is that the negative score of health and safety at work slightly increased in the months before the removal of Tesla from the index.

Figure 2: Tesla ESG scores for volumes and sentiments (1-year moving average), all source types, select subtopics.

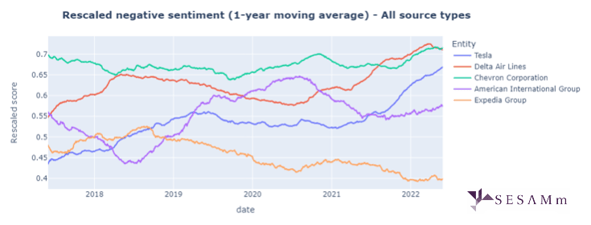

Comparing Tesla’s sentiment with other S&P 500 ESG Index companies

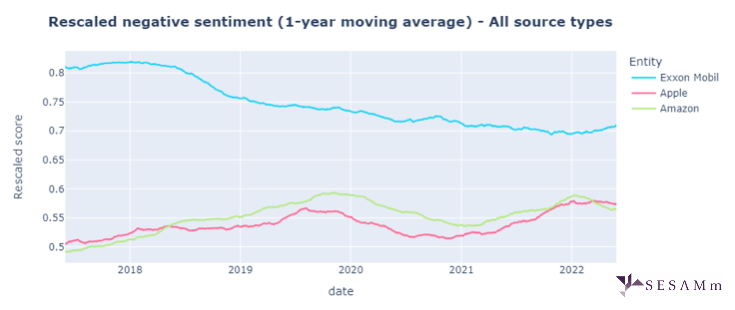

To see how Tesla’s ESG sentiment scores compared with other companies, we must rescale them with respect to a large universe of companies. This process means that for a given company, we use percentiles of the distribution of each subtopic’s ESG score to do a rescaling to the S&P 500 ESG constituents list after the 2022 rebalancing. Rescaling allows us to compare the companies with each other because the rescaled score indicates how bad the company is compared to the others, according to a specific ESG subtopic.

The following graphs show different sets of subtopics, plotting the mean of the respective rescaled scores if several topics are considered. Here are the companies considered.

Companies removed from the index:

- Tesla

- Delta Air Lines

- Chevron Corporation

Companies that joined the index after the 2022 rebalancing:

- American International Group

- Expedia Group

Companies still part of the index:

- Exxon Mobil

- Apple

- Amazon

Tesla, Delta, Chevron, AIG, and Expedia compared

Figure 3: Six-subtopic rescaled scores for Tesla, Delta, Chevron, AIG, and Expedia.

Apple, Amazon, and Exxon compared

Figure 4: Six-subtopic rescaled scores for Apple, Amazon, and Exxon.

The S&P 500’s choice is reasonable

Our analysis shows that the S&P 500’s decision to oust Tesla from the ESG index is reasonable. We found significant subtopic volumes and negative sentiment that support the S&P 500’s claims of racial discrimination, poor working conditions, and other controversies.

Thanks for reading this quick analysis. For a more detailed report, including Chevron’s and Delta’s ESG scores, reach out to a representative today.

SESAMm’s ready-to-use alternative data

Leverage our alternative data streams to incorporate systematic insights into your alpha signals or risk monitoring your entire portfolio. From tracking global sentiment to analyzing retail communities like WallStreetBets and integrating ESG alternative data into your systems, our solutions will make generating value from web insights easy.