The modern world is in a peculiar place right now. We’ve got the technology and resources to improve our planet, but we often don’t know how to use them despite our best intentions. Or, at the very least, we don’t know where to put our efforts.

Consequently, some investors are looking into Sustainable Development Goals (SDGs). Not only do they want their investments to earn more, but they also want them to do good. If you’re also interested in doing good with your investments, it’s essential to understand the SDGs and their meaning for your portfolio.

In this article, we’ll break down the SDG basics, SDG scores, their relevance to investing, and how SESAMm can help you get and read SDG metrics. But first, a quick review of SDGs.

What SDG means

SDGs, or Sustainable Development Goals, are a set of 17 goals that the United Nations set in 2015 to be achieved by the year 2030, a framework that “provides a shared blueprint for peace and prosperity for people and the planet, now and into the future.” The global goals and the 2030 Agenda for Sustainable Development cover issues such as human rights, poverty, health, education, gender equality, and environmental sustainability, and they were designed to be universal across countries and continents worldwide. Here are the 17 UN Sustainable Development Goals:

- SDG 1: No Poverty: Striving to end poverty in all its forms everywhere. This goal underscores the importance of equitable resource distribution and access to basic needs.

- SDG 2: Zero Hunger: Aiming to end hunger, achieve food security, improve nutrition, and promote sustainable agriculture, thereby ensuring that everyone, everywhere, has enough quality food to lead a healthy life.

- SDG 3: Good Health and Well-being: It emphasizes the need for universal healthcare access, including reproductive, maternal, and child healthcare, and combats health threats by supporting research and development of vaccines and medicines.

- SDG 4: Quality Education: Envisioning inclusive and equitable quality education and lifelong learning opportunities for all, this goal recognizes education as the foundation of empowerment and prosperity.

- SDG 5: Gender Equality: Achieving gender equality and empowering all women and girls to participate fully in societal, economic, and political spheres

- SDG 6: Clean Water and Sanitation: This goal aims to ensure the availability and sustainable management of water and sanitation for all, recognizing the essential role of water resources in sustaining life and ecosystems.

- SDG 7: Affordable and Clean Energy: Promoting access to affordable, reliable, sustainable, and modern energy for all; this goal underscores the critical nature of energy in achieving other SDGs and the transition towards renewable energy sources to combat climate change.

- SDG 8: Decent Work and Economic Growth: It focuses on promoting sustained, inclusive economic growth, full and productive employment, and decent work for all, highlighting the role of the private sector in initiating impactful initiatives.

- SDG 9: Industry, Innovation, and Infrastructure: Aiming to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation, this goal recognizes the importance of a robust infrastructure and an innovative ecosystem as drivers of economic growth and development.

- SDG 10: Reduced Inequalities: This goal seeks to reduce inequality within and among countries, focusing on policies designed to achieve greater equity and involve stakeholders from all sectors of society in decision-making processes.

- SDG 11: Sustainable Cities and Communities: It aims to make cities and human settlements inclusive, safe, resilient, and sustainable, emphasizing the need for green public spaces, improved urban planning, and sustainable construction practices.

- SDG 12: Responsible Consumption and Production: Focusing on promoting resource and energy efficiency, sustainable infrastructure, and providing access to a better quality of life for all, this goal underscores the importance of adopting sustainable practices and reducing waste.

- SDG 13: Climate Action: Taking urgent action to combat climate change and its impacts, this goal underscores the necessity for countries, stakeholders, and the private sector to collaborate in reducing emissions and enhancing renewable energy usage.

- SDG 14: Life Below Water: Aimed at conserving and sustainably using the oceans, seas, and marine resources for sustainable development, this goal addresses the critical importance of our aquatic ecosystems.

- SDG 15: Life on Land: Protecting, restoring, and promoting sustainable use of terrestrial ecosystems, sustainably managing forests, combating desertification, halting and reversing land degradation, and halting biodiversity loss.

- SDG 16: Peace, Justice, and Strong Institutions: Promoting peaceful and inclusive societies for sustainable development, providing access to justice for all, and building effective, accountable, and inclusive institutions at all levels.

- SDG 17: Partnerships for the Goals: This goal recognizes the importance of revitalizing the global partnership for sustainable development and the role of strong partnerships in achieving the SDGs, involving governments, the private sector, civil society, and others.

The UN’s 17 Sustainable Development Goals. Image courtesy of UN.org.

What are SDG scores?

Each Sustainable Development Goal has specific targets or indicators that help measure progress toward achieving those targets over time. SDG scores are numerical values given to each entity (country, company, person, etc.) based on their performance in meeting specific targets or indicators for each particular goal. Incorporating these evaluations into the decision-making process is crucial for stakeholders across various sectors, including the private sector, healthcare, financial services, and more. These stakeholders can leverage insights from SDG scores to prioritize initiatives that address critical issues like climate change, emissions reduction, and ecosystem preservation.

How do SDGs relate to ESG?

The environmental, social, and governance (ESG) framework is a tool to achieve and comply with the SDG goals. From a company’s perspective, ESG and SDG frameworks emphasize the importance of measuring and reporting progress. Companies incorporating ESG criteria into their operations often report on their sustainability performance, which can directly show their contribution towards achieving specific SDGs. For investors, ESG metrics provide a tangible way to evaluate companies' potential risks and opportunities related to sustainability, which can also align with the broader objectives of the SDGs.

The SDGs primarily focus on global challenges such as poverty, inequality, climate change, and environmental degradation, which represent the environmental and social pillars of ESG.

Within the same principles, several of these goals directly relate to the governance pillar of ESG. On the one hand, goal 16 aims to reduce corruption and bribery, develop effective and transparent institutions, and ensure inclusive and representative decision-making. On the other hand, goal 17 strives to enhance international cooperation, encourage effective public, public-private, and civil society partnerships, and ensure that policies are coherent and integrated, all of which are governance-related issues.

While the SDGs might not explicitly label these aspects as 'governance' in the way the ESG framework and regulatory landscapes do, the inclusion of these goals demonstrates a clear recognition of the importance of governance in achieving sustainable development.

SDGs and ESG also have different purposes. ESG measures companies’ environmental, social, and governance performance risks and initiatives, while SDGs evaluate any entity’s performance in reaching its goals. Put another way, SDGs represent the goals, while ESG concerns methodology and processes.

Learn more: “Gain Insights From Financial and ESG Data Using AI: A Comprehensive Guide.”

Why are SDGs important to investors?

At the company level, SDGs help align corporate strategy with society’s needs. Because the UN designed SDGs to be measurable, countries, companies, and people can hold themselves accountable for progress toward achieving them. And because the goals are measurable, we can score a company’s efforts, giving you an indicator to invest responsibly by aligning your portfolios with SDGs.

According to a publication by McKinsey & Company, sustainable investing appears to have a positive effect, if any, on returns. In other words, investors care about SDGs not only because they benefit society but also because they measurably support better investment decisions. For example, by incorporating SDGs into company assessments, investors can identify well-run businesses that are better positioned to benefit from the positive effects of improved social and economic conditions. SDGs also allow investors to make better-informed decisions within a defined investment time horizon by focusing on a company’s business exposure toward them. Investors can thus better measure and track a company’s opportunity exposure as a result of its achievement of the SDGs.

How to measure an entity’s SDG score

There are tools available to measure progress toward each goal—and those tools will play an essential role in helping investors decide which entities they want to invest in and which ones they don’t want to support. For example, SESAMm’s platform, TextReveal®, can analyze web data to generate SDG scores for virtually any entity in our data lake.

How SESAMm provides SDG scores

SESAMm provides SDG scores through its platform, TextReveal, a platform that allows investors to gain insights into companies, people, or topics. Specifically, we use artificial intelligence (AI) to track entities’ contributions toward SDGs, including public and private companies.

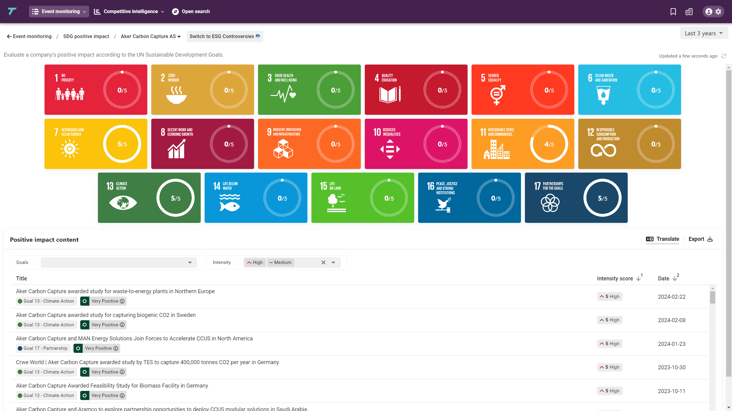

We track the 17 Sustainable Development Goals and the 169 underlying targets to detect negative news and positive events, using a similar algorithm we use for ESG alerts and gathering alternative data. Each UN SDG item displays a score from 0 to 5 to show the intensity of the company’s positive impact. Then, we translate the information into multiple languages.

This dashboard view example shows some SDG scores for Aker Carbon Capture.

We queried the Norwegian carbon capture company, Aker Carbon Capture, using our SDG positive impact dashboard over the past three years. As you might notice, Aker contributes to the goals associated with Partnerships, Climate Action, Clean Energy, and Sustainability. Maybe they could do more regarding Decent Work and Economic Growth, and Responsible Consumption and Production, but overall, the company’s online data shows a positive contribution.

See how SESAMm can help you with your SDG research

SESAMm is the leading provider of AI solutions and analytics for investment firms and corporations.

Our AI and NLP platform, TextReveal:

- Analyzes text in billions of web-based articles and messages

- Generates investment insights, ESG and SDG analysis used in systematic trading, fundamental research, risk management, and sustainability analysis

- Enables a more quantitative approach to leveraging the value of web data that’s less prone to human bias

- Addresses a growing need in public and private investment sectors for robust, timely, and granular sentiment and SDG data

SESAMm’s AI Technology Reveals ESG Insights

Discover unparalleled insights into ESG controversies, risks, and opportunities across industries. Learn more about how SESAMm can help you analyze millions of private and public companies using AI-powered text analysis tools.