As the year comes to an end, we wanted to highlight the most relevant ESG controversies during 2023. This article zeroes in on these risks, showing their critical role in corporate ethics and responsibility. Throughout the year, we've seen a variety of governance-related challenges that highlight the urgent need for corporate accountability.

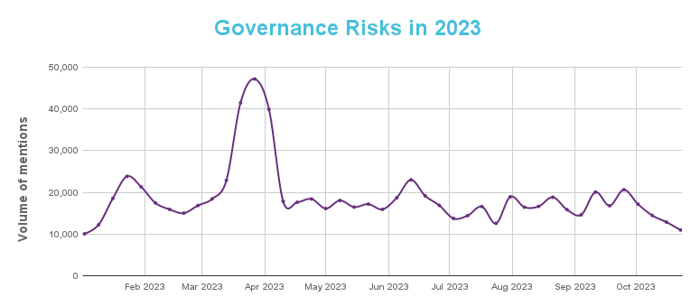

Governance Risks: Focus 2023

We highlighted the most significant governance risks in 2023. From tax evasion to ethical breaches such as bribery, these issues highlighted the growing importance of strong, ethical governance in corporate conduct.

Governance Controversies of 2023

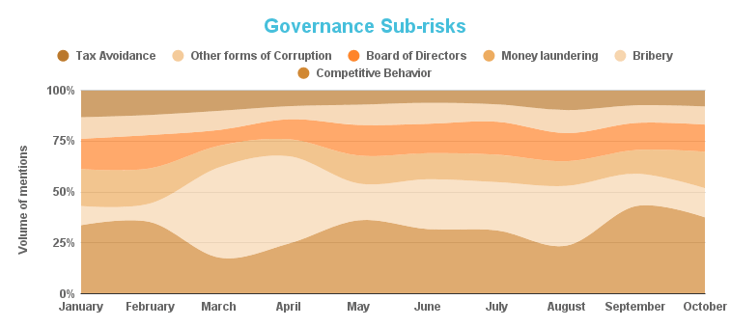

Governance risks, though often overlooked, play a pivotal role in shaping corporate responsibility and ethical conduct. In 2023, several governance controversy trends emerged:

Money Laundering

Tax evasion was a major topic of discussion in the first quarter, highlighting the need for greater transparency and accountability within corporations.

Bribery

There was a significant increase in mentions related to bribery cases, underscoring the challenges in maintaining ethical governance standards.

Competitive Behavior

This year has witnessed a rise in competitive conduct controversies, with several companies being scrutinized. Antitrust violations, price manipulation, and digital advertising dominance are central to these disputes.

Top 5 Governance Controversies

These controversies are ranked by relative volume*.

- FTX

Volume of mentions: 8,085

Relative volume: 40%

FTX, a notable entity in the financial sector, found itself at the center of governance controversies. A significant portion of the discussions surrounding FTX's governance risks in 2023 pertained to allegations of its founder's involvement in bribery schemes. (source)

- Apple

Volume of mentions: 3,162

Relative volume: 28%

Apple, a tech giant, faced scrutiny as a third of its governance risk mentions revolved around antitrust violations reported in October 2023. (source)

- Microsoft

Volume of mentions: 4,429

Relative volume: 25%

Microsoft encountered legal challenges with its deal with Activision. The company had to approach the court to reject the FTC's request to halt the deal. (source)

- X (formerly Twitter)

Volume of mentions: 2,251

Relative volume: 18%

X/Twitter, another major player in the tech industry, faced legal challenges when a judge dismissed a shareholder lawsuit against Elon Musk concerning a Twitter buyout. (source)

- Google

Volume of mentions: 3,920

Relative volume: 13%

Google faced judicial sanctions for allegedly destroying evidence in an antitrust case, further emphasizing the critical governance challenges even major tech giants face. (source)

Conclusion

In 2023, governance issues, particularly tax evasion and bribery, significantly impacted the ESG landscape, challenging corporate integrity and highlighting the importance of strong ethical standards. For private equity firms and financial institutions, these developments emphasize the value of AI-powered governance analysis in identifying risks and promoting transparency and accountability. The insights gained from this year's governance controversies are important for steering towards more responsible and sustainable business practices in the future.

Remember to check out the top 5 environmental and social controversies of 2023.

Relative volume*: Relative to the total volume of E, S, or G risks for the company during the same period.

SESAMm’s AI Technology Reveals ESG Insights

Discover unparalleled insights into ESG controversies, risks, and opportunities across industries. Learn more about how SESAMm can help you analyze millions of private and public companies using AI-powered text analysis tools.